- August 17, 2017

- Posted by: Mark S

- Categories: Advanced Trading Strategies, Trading Article

If you have been in the business of trading markets, you’ve no doubt not only jumped trading systems and strategies, but also markets.

Netpicks offers trading strategies that makes approaching different markets quite easy. In the right hands, it allows traders to find markets they are comfortable with, in the wrong hands, it allows people to “jump ship” during different market conditions.

What usually happens?

The Futures market, the Forex pair, or the stock you’ve been focused on starts to make a move. The problem is you left the market and are missing the breakouts that are now occurring.

It doesn’t have to be that drastic.

Trading the mini Russell a couple of days a week while looking at Forex the rest of the time is a recipe for disaster. That is something you’ve probably done (or still doing).

“It is always the best discretion to let the market show us where it is going and just simply follow (this would be prudent), rather than predict where the market is going and place a position (this would be gambling).” -Anne-Marie Baiynd

You Trade Markets With Your Edge

Keep in mind we have a system that puts the odds in our favor. The only way we can take advantage of those odds is to take the trades consistently in a given market according to a detailed trade plan.

That trade plan you put together for that market and instrument should have been based on back testing and then forward testing your trading strategy. Done right, this can be time consuming but it is what Troy at Netpicks calls “ditch digging”. Once you dig the ditch, you are ready to put in the foundation that should help sustain you throughout your trading career.

Cherry picking trades on different days or in different markets will never lead to consistent results. You will find yourself missing out on the winning trades and catching all the losers.

Don’t let a minor losing streak cause you to lose confidence in the system. If we are sticking to our guidelines of choosing the right markets and time frames, then over an extended number of trades, the odds will play out in our favor.

Are Markets Forever?

Marketing for diamonds may be “diamonds are forever” but does that hold true for markets? While jumping from instrument to instrument weekly is not good practice, is there ever a time you should consider jumping the fence for greener trading pastures?

We don’t want to force a market and time frame to work when the system is working well on so many different markets. The key is to keep a record of your trades on a daily basis in a trade journal. At the end of the month, go back and review the results for your given market.

You then have the opportunity to analyze whether or not the results are satisfactory.

If you find that the market really seems to be slowing down, then maybe this is the time to consider moving onto another market. Notice that I am not recommending you do this on a weekly basis. Markets will have down days or even weeks from time to time. That doesn’t mean a market is broken. If we start to see an extended draw down then you know it’s time to move on to another market.

Bonds used to be a favorite trading vehicle for a few years but when volatility began to fall, they were pushed to the back of the line. I don’t want to force these markets to work when other markets like currencies or crude oil are working well.

All I have to do is create a trade plan for one of the other markets and make the change.

But you don’t want to simply copy and existing trading plan. Markets have personalities and trade differently. Sometimes you are able to plug and play your current system but if the rhythm of the market is vastly different, dig your ditch.

5 Points To Consider Before Switching Markets

- Consider your winning percentage and your profit factor at the end of each month. If performance is taking a hit over an extended period of time, then consider taking your game to another market. At Netpicks, we like to see a 2/3 win rate however profit factor is the main driver.

- Are the trade profile shrinking? Markets have a rhythm and when it starts to break down, you will see that in the trading opportunities not having a large enough range. An example in the Forex market could be 100 pips traders were common and now you are looking at 50 pip profiles.

- Forward test other markets and simply track them. If your tracked markets are beginning to outperform the markets you are actively trading, maybe it’s time to dedicate some of your trading account to the movers.

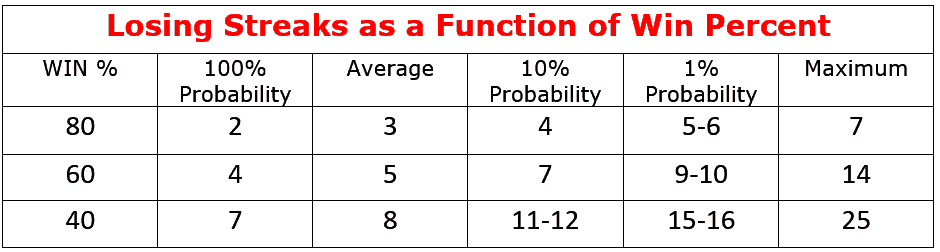

- Losing streaks happen and often time you can have runs where you feel like a win is never going to come. Your back testing should have highlighted expected losing streaks but if your draw down is extending, maybe move on.

- Are you switching markets out of frustration or statistics? Trading can be emotional and if you are allowing emotions instead of hard data to force your moves, you are are on the wrong track. Proper logging of trades is where you should focus in order to ensure you switching markets is done for the right reasons.

The best traders I know are aware of the markets that fit their trading style. They specialize in a handful of markets, which allows them to master the art of trading in those markets.

Don’t panic when you hit a losing streak.

At the same time, don’t be afraid to give up a market that you have always traded if you find other markets to be producing better results.

2 Comments

Comments are closed.

[…] at commodities in agriculture such as feeder cattle or trading wheat futures, if you’re into trading bonds if you’re out of the U.S. and are interested in spread betting – there are so many options out […]

[…] which provide lots of price action. But what about bonds? In this lesson, I’m going to give you trading bonds explained as a new trader guide to online treasury securities and […]