- January 12, 2024

- Posted by: CoachShane

- Categories: Options Trading, Trading Article

Zero-day options are options contracts that are set to expire at the end of the trading day, offering both high-risk and high-reward opportunities for traders.

Zero days to expiration options are like regular options contracts, but they come with a twist – they expire within a day. This means that you need to monitor the market throughout the trading day to jump on profitable opportunities that fit your trading plan. While zero-day options can yield substantial returns if the underlying security moves in your desired direction, recognize that they also carry the risk of losing the premium paid if the option expires out of the money.

Zero days to expiration options are like regular options contracts, but they come with a twist – they expire within a day. This means that you need to monitor the market throughout the trading day to jump on profitable opportunities that fit your trading plan. While zero-day options can yield substantial returns if the underlying security moves in your desired direction, recognize that they also carry the risk of losing the premium paid if the option expires out of the money.

- Zero days to expiration options are regular options contracts that expire at the end of the trading day.

- They offer high-risk, high-reward trading opportunities for retail traders.

- Zero-day options can result in significant profits if the underlying security moves in the desired direction.

- There is a risk of losing the premium paid if the option expires out of the money.

What Are Options Contracts?

Options contracts are financial derivatives that give you the right, but not the obligation, to buy or sell an underlying security at a specific price, known as the strike price, within a certain time, known as the expiration date. These contracts are often used as a hedging or speculative tool.

Understanding Options Contracts

To be successful with options trading, it is essential to understand the core elements of options contracts. The strike price represents the predetermined price at which the underlying asset will be bought or sold. The expiration date defines the time frame within which the option contract can be exercised. The underlying asset refers to the security, such as stocks or commodities, on which the options contract is based.

Influence of Time Decay on Options

When trading options, you should understand the impact of time decay, also known as theta. Options contracts are subjected to time decay, which means they gradually lose value as time passes. This occurs because options have expiration dates, and as the expiration date approaches, the probability of the option being profitable decreases.

As a result, if the underlying security’s price remains relatively stagnant or moves against the option holder’s position, the option’s value can decrease. This influence of time decay requires traders to assess the effect of time when developing their options trading strategies.

Options Trading Strategies

Options trading offers a wide range of strategies that you can use to achieve your investment goals. These strategies can be categorized into bullish, bearish, or neutral strategies, depending on your outlook on the market.

| Strategy | Description | Risk-Reward Profile |

|---|---|---|

| Covered Call | Owning the underlying asset and selling call options against it | Limited upside potential, limited downside protection |

| Protective Put | Buying put options to hedge against downward movements | Limited downside risk, potential for upside |

| Straddle | Simultaneously buying call and put options at the same strike price | Potential for significant profit, high risk |

| Strangle | Similar to a straddle, but with different strike prices for the call and put options | Potential for significant profit, high risk |

| Iron Condor | Selling both a bullish and bearish vertical spread | Limited profit, limited risk |

One common strategy is the covered call, where you own the underlying asset and sell call options against it to generate income. Another strategy is the protective put, which involves buying put options to hedge against potential downward movements in the underlying asset.

For more advanced traders, strategies like the straddle and strangle can be used to profit from significant price movements, regardless of the direction. These strategies involve buying both calls and put options with the same strike price but different expiration dates.

The iron condor is another popular strategy that takes advantage of market volatility. It involves selling both a bullish vertical spread and a bearish vertical spread on the same underlying asset, creating a range where you profit if the price remains relatively stable.

Deep Dive into Zero Days to Expiration Options

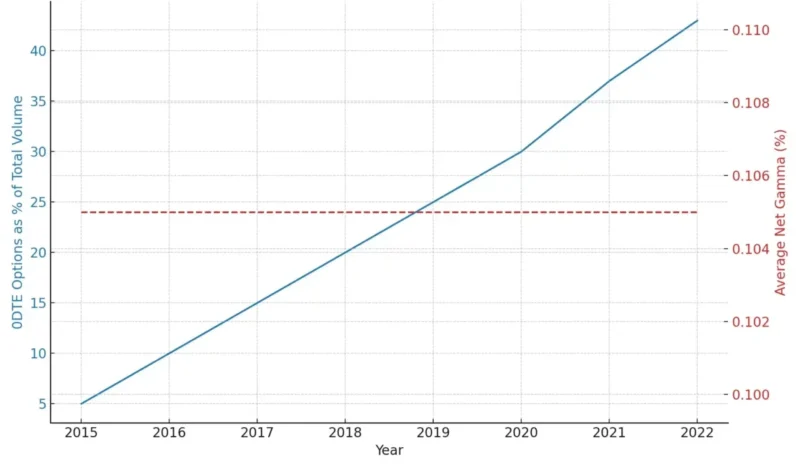

The trading volume of zero days to expiry (0DTE) options has been increasing significantly in recent years.

The blue line demonstrates how the volume of 0DTE options has increased in recent years. It started at 5% and has now reached 43% of the total volume (SPX). The red dashed line represents the average net gamma, which varies from 0.04% to 0.17%. This suggests that market makers have low overall exposure, despite the large trading volume.

What Sets 0DTE Options Apart in Options Trading?

Zero days to expiration options, also known as 0DTE options, function like regular options but have a lifespan of just one day, expiring at the close of the trading day. Traders are attracted to 0DTE options due to their potential for high returns.

However, they also come with increased risks, as the option can quickly lose value if the underlying security doesn’t move in the desired direction.

Popularity Surge of Zero-Day Options

The surge in popularity of zero-day options can be attributed to several factors.

- Short-term trading opportunities with the potential for quick profits have attracted retail investors looking to capitalize on market movements.

- Zero-day options also provide a more affordable entry point into options trading compared to longer-dated options contracts.

- The growing accessibility of options trading platforms and educational resources has contributed to the surge in popularity.

To further understand the rise in popularity, let’s take a closer look at some key reasons:

High-risk, high-reward potential: Zero-day options offer the chance to achieve significant profits within a single trading day if the underlying security moves favorably.

Flexibility and liquidity: With zero-day options, traders have the flexibility to enter and exit positions quickly due to the short expiration period. This increased liquidity allows for more efficient trading. There is a constant flow of buying and selling activity due to the short time frame, which results in increased liquidity.

Popularity among day traders: Day traders who focus on capitalizing on short-term market movements are attracted to zero-day options due to their potential for quick profits.

Evolution of trading strategies: The surge in popularity has led to the development and refinement of specific trading strategies tailored to zero-day options, attracting traders who seek innovative approaches to optimize their trading results.

Selecting the Optimal Expiration Date

Selecting the optimal expiration date is important for efficient options trading. In this section, we will compare the advantages and disadvantages of 0DTE (zero days to expiration) options with traditional DTE options. We will also look at how to determine the most efficient number of contracts to trade.

Selecting the optimal expiration date is important for efficient options trading. In this section, we will compare the advantages and disadvantages of 0DTE (zero days to expiration) options with traditional DTE options. We will also look at how to determine the most efficient number of contracts to trade.

0DTE vs. Traditional DTE Options

Remember, 0DTE options have a lifespan of just one trading day and expire at the close of the market. Traditional DTE options have longer expiration periods, typically ranging from several days to several months.

One advantage of 0DTE options is their potential for higher returns within a short timeframe. Since they expire quickly, they can provide opportunities to profit from same-day market movements. However, 0DTE options are also more volatile and can quickly lose value if the underlying security doesn’t move in the desired direction.

Traditional DTE options offer more flexibility in terms of planning and managing trades. With longer expiration periods, traders have more time to adjust their positions and take advantage of favorable market conditions. However, traditional DTE options may require a larger initial investment due to their longer durations.

How Many Contracts To Trade?

When determining the number of options contracts to trade (1 contract = 100 shares of the underlying), consider your risk tolerance and the potential impact of market volatility. Higher volatility may call for reducing the number of contracts to minimize potential losses, while lower volatility may allow for trading a larger number of contracts to capture greater profit potential.

It is also important to consider the size of your trading account and the percentage of capital you are willing to allocate to each trade. By diversifying your trades and not piling into a single position, you can better manage risk and protect your overall trading portfolio.

Our in-house Options specialist has his formula for deciding on the number of contracts. You can reach out to Mike at mike@netipicks.com

0DTE Strategies for Retail and Institutional Traders

These strategies revolve around taking positions based on predictions of market movements within the same trading day. By successfully implementing 0DTE strategies, traders can potentially achieve significant gains while effectively managing their risk.

These strategies revolve around taking positions based on predictions of market movements within the same trading day. By successfully implementing 0DTE strategies, traders can potentially achieve significant gains while effectively managing their risk.

High-Reward Trades: Concentrated Directional Risk

High-reward trades in 0DTE options involve concentrated directional risk, where traders take positions based on their expectations of the market’s movement in a specific direction. This strategy allows traders to maximize their profit potential by capitalizing on short-term price fluctuations within the same trading day. Note that concentrated directional risk also increases the potential for losses if the market moves in the opposite direction.

Case Studies: Short Positions in 0DTE Options

The retail trader conducted a technical and fundamental analysis of a particular stock. Through their analysis, the trader identified that the stock was facing strong resistance levels and believed that a significant price decline was coming especially after seeing a strong reversal candlestick was plotted with volume.

They decided to use a short position strategy using a 0DTE put option. A 0DTE put option expires at the end of the trading day, making it a highly short-term and speculative choice.

Trade Execution:

- Entry Point: The trader entered the trade at a specific moment dictated by their trading plan. They waited for a confirmation signal that the stock was likely to decline further within the same trading day.

- Shorting the Option: They sold short a 0DTE put option with a strike price near the current market price of the stock. This put option gave them the right to sell the stock at the strike price, which would be profitable if the stock’s price dropped below that level by the end of the trading day.

- Risk Management: To manage potential losses, the trader sets stop-loss orders to limit their downside risk. They were prepared to exit the trade if the market moved against them beyond a predefined point.

- Monitoring and Exit: Throughout the trading day, the trader closely monitored the stock’s price movement. As the stock price declined as predicted, the value of the put option increased.

- Profit Realization: The trader executed their exit strategy when they saw a substantial profit. They bought back the put option they had sold short, netting a profit from the price difference.

This case study shows how a retail trader used a 0DTE put option to profit from a short-term price decline in the stock, using a well-thought-out trading plan.

Out-of-the-money (OTM) calls are option contracts with strike prices above the current market price of the underlying asset. These calls hold the potential for gains if the underlying asset experiences a sharp rally, making them an attractive choice for traders seeking high-profit opportunities.

When trading OTM calls, you need to map the probability of their expiry. This involves assessing the likelihood of the underlying asset reaching the strike price before the option’s expiration date. By mapping the probability, traders can make better decisions and manage their risk effectively. If the instrument is range-bound, the likelihood of the strike price being hit is slim.

Sharp Rally Potential

The rally potential of OTM calls lies in the anticipation of a significant upward price movement in the underlying asset. Traders are attracted to these options with hopes of capturing substantial profits if the market experiences a sharp rally. However, you need to approach sharp rally expectations with caution, as they can often be deceptive and lead to losses if the anticipated rally never happens.

Vital Role of Theta: Time Decay’s Impact on Option Value

Theta, also known as time decay, plays a vital role in the pricing and value of options contracts. Traders must understand the concept of theta and its impact on option value to formulate effective options trading strategies.

Theta measures the rate at which the value of an option decreases as time passes. It represents the time decay component of an option’s price. As an option approaches its expiration date, the rate of time decay accelerates, causing the option’s value to diminish.

Theta measures the rate at which the value of an option decreases as time passes. It represents the time decay component of an option’s price. As an option approaches its expiration date, the rate of time decay accelerates, causing the option’s value to diminish.

When trading options, it’s important to consider the effects of time decay. Theta determines the pace at which an option loses value and can erode its profitability if the underlying security fails to move in the desired direction.

Maximizing Gains with 45DTE Duration Calls

Using 45DTE duration calls (45DTE calls refer to call options with a 45-day time to expiration) as part of your options approach requires careful consideration of various factors. You need to evaluate the current market conditions and assess the volatility of the underlying assets. This information will help you determine if 45DTE calls are suitable for your trading strategy.

It would be best if you considered your risk tolerance when using 45DTE calls. These options contracts have a longer lifespan compared to zero-days-to-expiration options, giving you more time to react to market movements. However, they still require thorough risk management to protect your capital.

By selecting 45DTE calls to your options portfolio, you can take advantage of the potential gains that come with a longer duration. These calls provide more flexibility and allow you to ride the waves of market volatility, increasing your chances of profit.

From Zero to Forty-Five: Best of Both Worlds

The transition from zero days to expiration to forty-five days to expiration can bring benefits to your options trading strategy. By diversifying your duration ranges, you minimize the potential risks associated with short-term options and increase the possibility for potential gains over the longer term.

- Zero days to expiration options offer same-day trading opportunities but come with higher risks and quick time decay.

- 45DTE duration calls provide a longer time frame for market movements to work in your favor and mitigate the impact of time decay.

By incorporating 45DTE duration calls into your options portfolio, you strike a balance between short-term and longer-term trading strategies. This diversification helps manage risk and allows you to explore a wider range of market conditions, ultimately maximizing your gains.

| Options Strategy | Duration | Advantages | Considerations |

|---|---|---|---|

| Zero days to expiration options | 0DTE | – Quick potential gains – Same-day trading opportunities |

– High risks – Quick time decay |

| 45DTE duration calls | 45DTE | – Longer time frame for market movements – Potential to mitigate time decay |

– Requires risk management – Longer exposure to market fluctuations |

By implementing a blend of zero-day-to-expiration options and 45DTE duration calls in your options portfolio, you can optimize your trading strategy to capture short-term opportunities while maintaining a more robust long-term approach.

Mastering 0DTE Options: Your Trading Plan

To effectively trade 0DTE options, you need a clear understanding of risk management, position sizing, and exit strategies. Developing a thorough trading plan is essential to maximize your potential for profits and minimize potential losses.

Importance of Keeping a Trade Journal

One key element of your trading plan should be keeping a trade journal. A trade journal allows you to record and analyze your trades, providing insights into your decision-making process and helping you identify patterns and areas for improvement. This is a vital step that many traders choose to ignore.

When maintaining a trade journal, be sure to include the following information for each trade:

- Trade date and time

- Underlying asset

- Type of option (call or put)

- Strike price and expiration date

- Entry and exit points

- Profit or loss

- Any notes or observations – especially about yourself during winning and losing trades

By recording and analyzing your trades, you can identify successful strategies and areas where adjustments are needed. A trade journal helps you track your progress and enables you to review past trades objectively. Trade journals are something Netpicks has been a supporter of since we started over two decades ago.

Disciplined Approach to 0-Day Trading

Zero-day trading requires a disciplined approach to ensure consistent results. Here are a few key principles to consider:

- Stick to your trading plan: Follow the guidelines outlined in your trading plan and avoid making impulsive decisions based on emotions or short-term market fluctuations.

- Manage your risk: Set a predetermined risk level for each trade and use proper position sizing to limit the effect of potential losses.

- Stay informed: Continuously educate yourself about the market, stay updated on news and events, and adapt your trading strategies when needed.

- Practice patience: Avoid the temptation to overtrade or chase profits. Patience and discipline are essential qualities for successful zero-day trading.

By adhering to a disciplined approach, you can maintain consistency in your trading and increase your chances of long-term profitability.

Conclusion

Exploring zero-days to expiration options trading opens up a world of opportunities for traders to capitalize on same-day market movements. By understanding the core concepts of options contracts, the dynamics of time decay, and the various strategies that can be used for zero-day trading, you can find success with this approach.

You need to assess the risks involved and adopt a disciplined approach to ensure long-term profitability. Remember, to make the most of zero-day to-expiration options trading, you must stay updated on market movements, develop effective trading strategies, carefully assess the risks, and consistently evaluate the profitability of your trades.

FAQ

What are zero days to expiration options?

Zero days to expiration (0DTE) options are regular options contracts that are set to expire at the end of the trading day. They offer traders the opportunity to capitalize on same-day market movements.

How do option contracts work?

Options contracts give the holder the right, but not the obligation, to buy or sell an underlying security at a specific price within a certain period. They are commonly used for hedging or speculation in the financial markets.

What is the impact of time decay on options?

Time decay, also known as theta, causes option contracts to lose value as time passes. Traders need to consider the effect of time when formulating their options trading strategies.

What are some common options trading strategies?

Some common options trading strategies include covered calls, protective puts, straddles, strangles, and iron condors. Each strategy has its risk-reward profile and requires a unique approach.

Why have zero-days-to-expiration options gained popularity?

Zero days to expiration options have gained popularity due to their potential for high returns. These options expire at the close of the trading day and offer opportunities for quick profits if the underlying security moves in the desired direction.

How do zero days-to-expiration options compare to traditional days-to-expiration options?

Traders need to consider various factors, such as market volatility and their trading objectives when choosing the expiration date for options contracts. The optimal expiration date differs between zero days to expiration and traditional options.

What high-reward trades can be applied to zero days to expiration options?

High-reward trades involving concentrated directional risk can be applied to zero days to expiration options. Traders take positions based on their predictions of market movements to potentially achieve significant gains.

What are the risks of trading zero days to expiration options?

Trading zero-day-to-expiration options come with risks, such as the potential for significant losses if the underlying security doesn’t move as anticipated. It is important to identify and manage these risks effectively.

What are out-of-the-money (OTM) calls, and why are they attractive?

Out-of-the-money calls are option contracts with strike prices above the current market price of the underlying asset. They offer the potential for significant gains if there is a sharp rally in the market and are cheaper than ITM options.

What is the role of theta in options trading?

Theta, also known as time decay, plays a role in the pricing and value of options contracts. Traders need to understand theta and its impact to maximize the potential profitability of their options trades.

How can traders maximize gains with 45 days-to-expiration duration calls?

Traders can apply 45-day-to-expiration (45DTE) duration calls to their options portfolio, considering factors such as market conditions, volatility, and risk tolerance. Incorporating 45DTE duration calls can potentially enhance gains and improve overall trading performance.

How can traders master zero days to expiration options?

Traders can master zero-day expiration options by creating an effective trading plan that includes risk management, position sizing, and exit strategies. It is also important to keep a trade journal and maintain discipline in trading.