- February 26, 2024

- Posted by: CoachShane

- Categories: Advanced Trading Strategies, Trading Article, Trading Indicators

“Did you know that 3 simple lines on a chart could potentially predict the next major market move?”

The MACD (Moving Average Convergence Divergence) and RSI (Relative Strength Index) indicators are popular technical tools used by traders to measure trend strength, identify potential reversals, and determine overbought or oversold conditions.

The MACD (Moving Average Convergence Divergence) and RSI (Relative Strength Index) indicators are popular technical tools used by traders to measure trend strength, identify potential reversals, and determine overbought or oversold conditions.

In this guide, we’ll look at both the MACD and RSI indicators, explaining how they work and their role in trading strategies.

What is the MACD Indicator and How Does it Work?

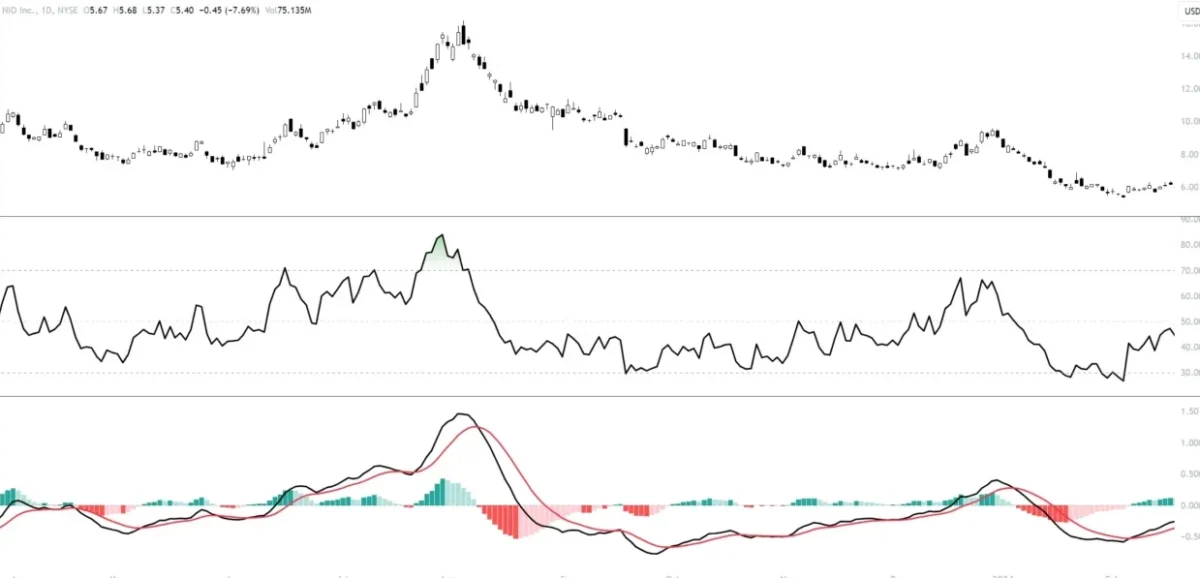

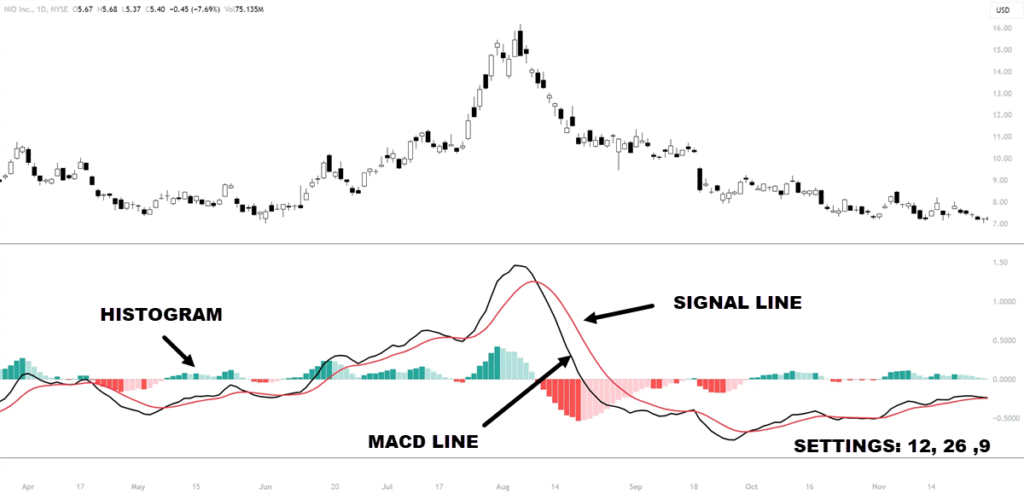

The MACD indicator, short for Moving Average Convergence Divergence, consists of two lines – the MACD line and the signal line – as well as a histogram that represents the difference between the two lines. The MACD indicator helps identify potential trend reversals, as well as the strength and direction of price trends.

Traders use the MACD indicator in conjunction with other technical analysis tools to generate trading signals and understand the momentum in the instrument. By analyzing the relationship between the MACD line and the signal line, traders can identify changes in momentum and potential trend reversals.

The MACD histogram also provides visual cues about the strength and magnitude of price movements.

To calculate the MACD indicator, you subtract the 26-day exponential moving average (EMA) from the 12-day EMA, resulting in the MACD line. The signal line is typically a 9-day EMA of the MACD line. The histogram is then derived from the difference between the MACD line and the signal line, representing the convergence and divergence of the two lines.

| Component | Description |

|---|---|

| MACD Line | The 12-day EMA minus the 26-day EMA |

| Signal Line | A 9-day EMA of the MACD line |

| Histogram | The difference between the MACD line and the signal line |

The MACD indicator is also useful for identifying trend reversals.

When the MACD line crosses above the signal line, it generates a bullish signal, indicating potential buying opportunities. When the MACD line crosses below the signal line, it generates a bearish signal, indicating potential selling opportunities. Also pay attention to the magnitude of the histogram bars, as larger bars indicate stronger momentum.

Understanding the RSI Indicator

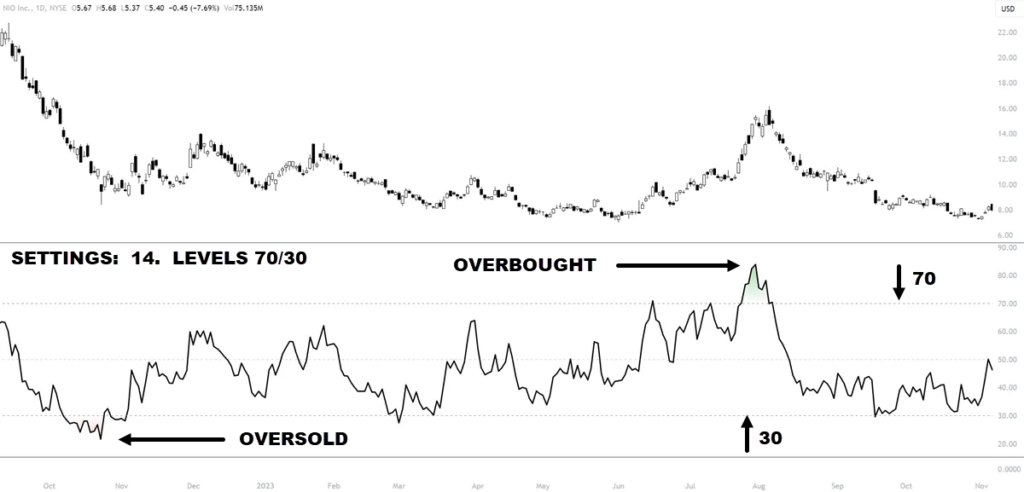

The RSI (Relative Strength Index) indicator is a momentum oscillator that measures the strength and speed of price movements. It helps traders identify potential trend reversals and signal overbought and oversold market conditions.

The RSI indicator is plotted on a scale of 0 to 100 and is based on the ratio of upward price movements to downward price movements over a specified period. The indicator provides a numerical value that oscillates between these two extremes, indicating the current strength or weakness of the price action.

The RSI indicator is plotted on a scale of 0 to 100 and is based on the ratio of upward price movements to downward price movements over a specified period. The indicator provides a numerical value that oscillates between these two extremes, indicating the current strength or weakness of the price action.

- Values above 70 on the RSI scale indicate an overbought condition, suggesting that a security may be due for a price correction or reversal.

- Values below 30 indicate an oversold condition, indicating that a security may be undervalued and due for a potential upward price movement.

Traders use the RSI indicator in combination with other technical analysis tools to confirm potential trading signals and make informed trading decisions. By adding the RSI indicator to their analysis, traders can identify favorable entry and exit points, as well as potential trend shifts.

| RSI Reading | Market Condition |

|---|---|

| Below 30 | Oversold |

| Between 30 and 70 | Neutral |

| Above 70 | Overbought |

When using the RSI indicator, it’s important to remember that it should not be used as the sole basis for making trading decisions, as no indicator is foolproof. It is advisable to combine the RSI indicator with other technical analysis tools, such as trendlines, moving averages, and support and resistance levels, to increase the accuracy of potential trading signals.

Significance of MACD and RSI in Technical Analysis

The MACD indicator, with its two lines (MACD line and signal line) and histogram, helps identify potential trend reversals. It measures the convergence and divergence of moving averages, indicating shifts in market momentum. Traders use the MACD indicator along with other technical analysis tools to generate trading signals and make informed trading decisions.

The RSI indicator is a momentum oscillator that measures the strength and speed of price movements. It indicates whether a market is overbought or oversold, highlighting potential trend reversals. The RSI indicator is plotted on a scale of 0 to 100, with values above 70 indicating overbought conditions and values below 30 indicating oversold conditions.

By combining the RSI indicator with other technical analysis tools, traders can confirm potential trading signals and improve their trading success.

Role of MACD and RSI in Technical Analysis

When used in conjunction with other technical analysis tools, the MACD and RSI indicators can provide powerful insights and improve the accuracy of trading signals.

When used in conjunction with other technical analysis tools, the MACD and RSI indicators can provide powerful insights and improve the accuracy of trading signals.

Here are some key ways these indicators contribute to technical analysis:

- Identifying Potential Trend Reversals: The MACD indicator can signal potential trend reversals when the MACD line crosses above or below the signal line. This crossover indicates a shift in market momentum and can help traders identify potential entry or exit points.

- Determining Overbought and Oversold Conditions: The RSI indicator identifies overbought and oversold conditions in the market. Traders can use these signals to identify potential trend reversals and anticipate price movements.

- Confirming Trading Signals: By combining signals from the MACD and RSI indicators, traders can increase the reliability of their trading signals. When both indicators align and confirm a particular trading signal, it strengthens the validity of the signal and provides additional confidence to traders.

- Providing Trading Range Insights: The MACD indicator’s histogram can provide insights into the trading range of an asset. Traders can analyze the width and height of the histogram bars to assess changes in volatility and trading activity.

- Analyzing Divergence Patterns: Divergence patterns between the price action and the MACD or RSI indicators can provide valuable insights into potential trend reversals. Bullish or bearish divergences can indicate shifts in market sentiment and offer opportunities for traders.

Trading Signals and Strategies

By using the MACD and RSI indicators in technical analysis, traders can generate trading signals and implement various trading strategies. These strategies can range from swing trading to day trading and can be adapted to different markets and timeframes.

| Strategy | Description |

|---|---|

| MACD and RSI Crossover Strategy | This strategy involves using the crossover of the MACD and RSI indicators to identify potential entry and exit points. Traders look for specific crossover patterns and conditions to generate trading signals. |

| MACD and RSI Divergence Strategy | This strategy focuses on identifying divergence patterns between the price action and the MACD or RSI indicators. Traders look for bullish or bearish divergences to anticipate potential trend reversals and generate trading signals. |

| MACD and RSI Trend Reversal Strategy | This strategy aims to capture trend reversals by combining signals from the MACD and RSI indicators. Traders look for specific reversal patterns and confirmations to identify potential entry and exit points. |

80-20 RSI Trading Strategy: Step-by-Step Guide

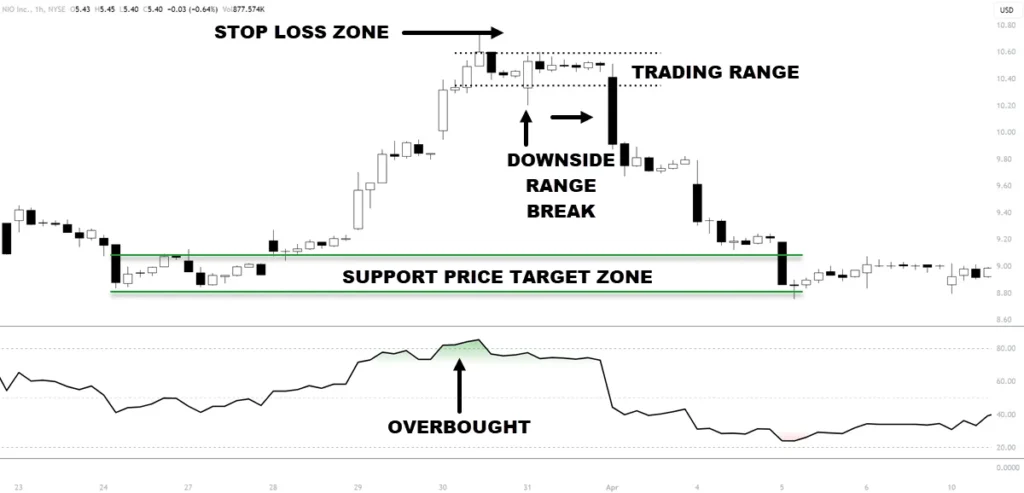

The 80-20 RSI Trading Strategy is an approach that uses the Relative Strength Index (RSI) indicator to identify potential trade entries. By setting specific thresholds for the RSI oscillator (80/20), traders can determine overbought and oversold conditions, which can be used to anticipate market reversals and potential trading opportunities.

Step 1: Understanding the RSI Indicator

Step 1: Understanding the RSI Indicator

The RSI is a momentum oscillator that measures the strength and speed of price movements. It is plotted on a scale of 0 to 100, with values above 70 indicating overbought conditions and values below 30 indicating oversold conditions.

To implement the 80-20 RSI Trading Strategy, traders will be focusing on RSI values above 80 as potential selling opportunities and RSI values below 20 as potential buying opportunities.

Step 2: Identifying Overbought and Oversold Conditions

The next step is to identify overbought and oversold conditions using the RSI indicator. When the RSI value crosses above 80, it suggests that the market is overbought, and a potential selling opportunity may arise. When the RSI value crosses below 20, it indicates that the market is oversold, and a potential buying opportunity.

Step 3: Trading Rules and Execution

The trading rules for the 80-20 RSI Trading Strategy are straightforward:

- If the RSI value crosses above 80, consider selling or shorting the instrument.

- If the RSI value crosses below 20, consider buying or going long on the instrument.

Wait for additional confirmation signals before entering a trade. This can include price patterns, trendlines, or other technical indicators that align with the RSI signal.

Step 4: Managing Risk and Exit Strategies

Determine your risk tolerance and set stop-loss orders to limit potential losses in case the market moves against your position. Consider setting profit targets or trailing stops to secure profits as the trade progresses to benefit from any sustained price moves.

It’s important to evaluate your trades regularly and adapt your strategy based on market conditions. Keep track of your trades, analyze your performance, and make adjustments as needed to improve your trading results.

The MACD and RSI Crossover Strategy for Swing Trading

The MACD and RSI Crossover Strategy is a swing trading strategy that combines the power of the MACD and RSI indicators to identify potential trade entries. This strategy is particularly effective for capturing medium-term changes in the trend and can be applied in various markets. A daily chart would be a great one for this strategy.

Here’s how the MACD and RSI Crossover Strategy works:

Here’s how the MACD and RSI Crossover Strategy works:

- When the MACD line crosses above the signal line and the RSI indicator is in an oversold condition, it can signal a potential buying opportunity.

- Conversely, when the MACD line crosses below the signal line and the RSI indicator is in an overbought condition, it can signal a potential selling opportunity.

By taking advantage of the crossover signals between the MACD and RSI indicators, you can identify potential entry and exit points that align with the current market trend. This strategy allows traders to capitalize on swing trading opportunities and capture profits from medium-term price movements.

Traders would initiate a buy trade when the MACD line crosses above the signal line and the RSI indicator is in or rising from an oversold condition.

A sell trade would be initiated when the MACD line crosses below the signal line and the RSI indicator is in an overbought condition. The trade result column indicates whether each trade resulted in a profit or loss.

While the MACD and RSI Crossover Strategy can be a valuable tool for swing trading, it should not be relied upon as the sole basis for trading decisions. Traders should also consider other technical analysis indicators and practice proper risk management.

In the example, I used a support level bounce along with a trend line break to help confirm what the indicators were telling me. The profit target was a former resistance zone.

MACD and RSI Day Trading Strategy

The MACD and RSI Day Trading Strategy is a short-term trading strategy that focuses on intraday price movements. This strategy is particularly useful for traders who want to capitalize on short-term price fluctuations in lower time frames. By using the crossover of the MACD and RSI indicators, traders can identify potential trade entries and exits.

When applying the MACD and RSI Day Trading Strategy, traders look for specific signals to determine their trading actions.

When applying the MACD and RSI Day Trading Strategy, traders look for specific signals to determine their trading actions.

- A potential buying opportunity is signaled when the MACD line crosses above the signal line and the RSI indicator is below a predetermined level.

- A potential selling opportunity is indicated when the MACD line crosses below the signal line and the RSI indicator is above a certain level.

- Add in support levels for buying for increased chances of success.

- Early entry can be when the histogram makes an obvious move higher indicating the start of a MACD rise and cross.

This day trading strategy enables traders to take advantage of short-term price movements on lower time frame charts such as this 15-minute chart.

Benefits of the MACD and RSI Day Trading Strategy

There are several benefits to implementing the MACD and RSI Day Trading Strategy:

- Quick profits: By focusing on intraday price movements, traders have the potential to generate quick profits within a short period.

- Reduced risk exposure: Since day trading involves closing positions within the same trading day, traders can minimize the risks associated with overnight price fluctuations.

- Increased trading opportunities: The MACD and RSI indicators provide frequent trading signals, offering traders numerous opportunities to enter and exit trades throughout the day.

While the MACD and RSI Day Trading Strategy can be highly profitable, it also requires careful risk management and discipline.

Traders should:

- Set clear entry and exit points

- Establish stop-loss orders

- Adhere to proper money management techniques

Mastering the MACD and RSI Day Trading Strategy takes time and practice. Traders should dedicate themselves to learning how to interpret the MACD and RSI indicators, identifying optimal entry and exit points, and fine-tuning their trading skills.

MACD and RSI Divergence Strategy

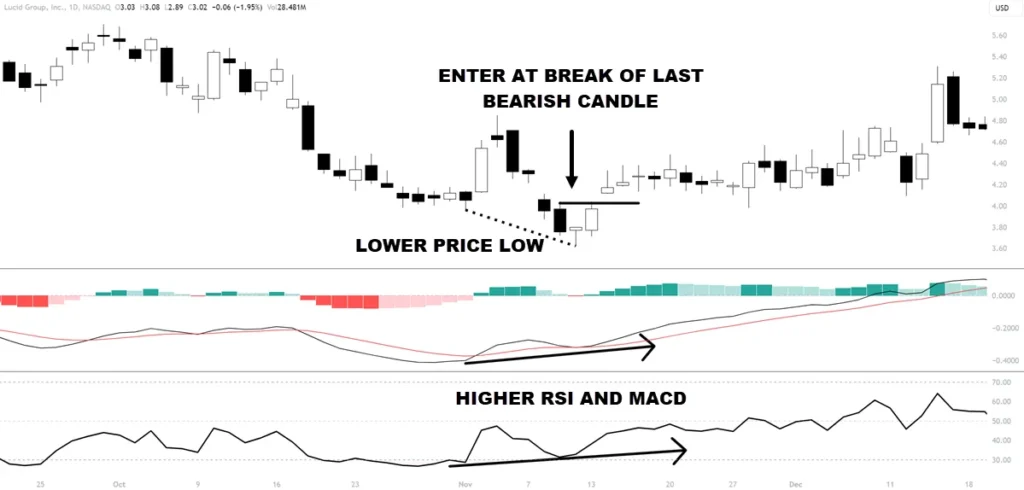

The MACD and RSI Divergence Strategy is a powerful trend reversal strategy that uses the divergence between the MACD and RSI indicators to identify potential trade entries. Divergence occurs when the price movement of an asset is moving in the opposite direction of the indicators, indicating a potential change in the trend.

Traders using this strategy look for two main types of divergence: bullish and bearish.

Traders using this strategy look for two main types of divergence: bullish and bearish.

- A bullish divergence occurs when the price makes a lower low, but the MACD and RSI indicators make a higher low. This suggests a possible upward trend reversal and a potential buying opportunity.

- Bearish divergence occurs when the price makes a higher high, but the MACD and RSI indicators make a lower high. This indicates a potential downward trend reversal and a possible selling opportunity.

Traders can use this strategy in different timeframes and markets, such as stocks, forex, or commodities, to capture trend reversals and generate profitable trades.

Example:

Let’s take an example to illustrate the MACD and RSI Divergence Strategy. Assume we are analyzing the price of a stock, and we observe a bullish divergence on the daily chart.

- The stock’s price makes a lower low, but the MACD indicator and RSI indicator make a higher low.

- This indicates a potential trend reversal from downward to upward.

- Traders using this strategy may view this as a buying opportunity and use various entry strategies as noted on the chart.

By analyzing divergence patterns and combining them with other technical analysis tools, traders can increase their chances of making profitable trades using the MACD and RSI Divergence Strategy.

Tips for Success with the MACD and RSI Strategy

When it comes to using the MACD and RSI strategies, several tips can greatly improve your trading results.

1. Set Clear Trading Rules

One of the first steps to success with the MACD and RSI Strategy is to establish clear trading rules. Define your entry and exit criteria, risk tolerance, and profit targets. Having a well-defined plan will help you stay focused and objective during the trading process.

2. Implement Proper Risk Management

Use appropriate position sizing techniques to ensure that your risk is limited on each trade. Consider using stop-loss orders to protect your capital and avoid significant losses. By managing your risk effectively, you can protect your account from unnecessary drawdowns and preserve your trading capital.

3. Stay Disciplined

Discipline is key to success in any form of trading. Stick to your trading plan and avoid impulsive decisions based on emotions. Follow your predetermined rules and avoid deviating from your strategy. Consistency and discipline are essential for long-term profitability.

4. Continuously Learn and Adapt

The market is constantly changing, and as a trader, you need to adapt accordingly. Keep learning and stay updated with the latest trends and developments. Continuously improve your trading skills and seek knowledge from reliable sources such as our YouTube channel.

5. Backtest and Analyze Historical Data

Before trading with real money, backtest your strategy using historical data. This allows you to assess the performance of your strategy under different market conditions. Analyze the results and make adjustments to optimize your strategy. Keeping a trading journal can also help track your performance and identify areas for improvement.

6. Manage Your Emotions

Emotions can often cloud judgment and lead to poor trading decisions. Keep your emotions in check and avoid making impulsive trades based on fear or greed. Develop a mindset that is focused on long-term profitability rather than short-term gains. Emotional control is crucial for consistent trading success.

7. Seek Professional Guidance

If you are new to trading or want to improve your skills, consider seeking guidance from experienced traders or professionals. They can provide insights, tips, and strategies to help you improve your trading performance.

Joining trading communities or forums can also provide opportunities to learn from peers and share experiences.

Summary

The MACD and RSI Strategy is a versatile and effective approach to trading that combines the strengths of the MACD and RSI indicators. It is important to remember that no strategy guarantees profits, and as a trader, you should always practice proper risk management and continuously educate yourself to continuously improve your trading.

FAQ

What is the MACD Indicator and How Does it Work?

The MACD indicator, short for Moving Average Convergence Divergence, measures the convergence and divergence of moving averages. It consists of two lines – the MACD line and the signal line – as well as a histogram that represents the difference between the two lines. The MACD indicator helps identify potential trend reversals and the strength and direction of price trends.

What is the RSI Indicator and How Does it Work?

The RSI (Relative Strength Index) indicator is a momentum oscillator that measures the strength and speed of price movements. It indicates whether a market is overbought or oversold, which can indicate potential trend reversals. Traders use the RSI indicator to confirm trading signals.

How does the 80-20 RSI Trading Strategy work?

The 80-20 RSI Trading Strategy sets thresholds for the RSI oscillator at 80 and 20 to determine overbought and oversold conditions. Traders look for RSI values above 80 to indicate overbought conditions and potential selling opportunities, and RSI values below 20 to indicate oversold conditions and potential buying opportunities.

How does the MACD and RSI Crossover Strategy work for Swing Trading?

The MACD and RSI Crossover Strategy for Swing Trading uses the crossover of the MACD and RSI indicators to identify potential trade entries. When the MACD line crosses above the signal line and the RSI indicator is oversold, it can signal a potential buying opportunity. When the MACD line crosses below the signal line and the RSI indicator is overbought, it can signal a potential selling opportunity.

How do the MACD and RSI Day Trading Strategy work?

The MACD and RSI Day Trading Strategy focuses on short-term price movements. Traders use the crossover of the MACD and RSI indicators to identify potential trade entries and exits. When the MACD line crosses above the signal line and the RSI indicator is below a certain level, it can signal a potential buying opportunity. Conversely, when the MACD line crosses below the signal line and the RSI indicator is above a certain level, it can signal a potential selling opportunity.

How does the MACD and RSI Divergence Strategy work?

The MACD and RSI Divergence Strategy uses the divergence between the MACD and RSI indicators to identify potential trend reversals. Divergence occurs when the price is moving in the opposite direction of the indicators, indicating a potential trend reversal. Traders look for a bullish or bearish divergence to signal potential buying or selling opportunities.

How do the MACD and RSI Trend Reversal Strategies work?

The MACD and RSI Trend Reversal Strategy focuses on identifying potential trend reversals using the signals from the MACD and RSI indicators. Traders analyze specific patterns and signal confirmations, such as bullish or bearish divergences, to identify potential trend reversals. By combining the signals from the MACD and RSI indicators, traders can increase their chances of catching trend reversals early.

What are some tips for success with the MACD and RSI Strategy?

Some tips for success with the MACD and RSI Strategy include setting clear trading rules, using proper risk management techniques, staying disciplined, and continuously learning and adapting to market conditions. It is also important to backtest the strategy, analyze historical data, and keep a trading journal to track performance and identify areas for improvement.

What is the significance of the MACD and RSI indicators in technical analysis?

The MACD indicator helps identify potential trend reversals, while the RSI indicator indicates overbought and oversold conditions. Traders use these indicators in conjunction with other technical analysis tools to generate trading signals and make informed trading decisions.

Step 1: Understanding the RSI Indicator

Step 1: Understanding the RSI Indicator