- March 18, 2020

- Posted by: CoachShane

- Categories: Swing Trading, Trading Article, trading videos

A trading setup that forms as part of your trading strategy is in need of a trade trigger to get you active in the position.

Having a way to trigger into a trade can stop you from letting your emotions dictate your positions.

In this article, we will discuss what a trading trigger is and various methods you can use.

What Is A Trade Trigger

When price gets to an area of interest, you don’t simply jump into a position without some type of sign that the price is moving in your direction.

Looking at this chart, we have a confluence of technical factors that include:

A. Former resistance area broken & is a Fibonacci cluster zone

B. Pivot level plus large momentum

C. Pullback to a moving average

D. Not seen but also a ’50 level

If you were just waiting for price to enter your confluence zone to enter the trade and not a trade trigger, you can see you were taken out with momentum

Another positive about waiting for a trade trigger is you won’t just “jump in” to a large bear or bull candle by letting emotions take over. Not only can these candles signify an temporary exhaustion in the move but you can also get some large slippage as you market entry into the trade.

If emotionally entering a trade because you see a large candle (yes, people do that), then you clearly don’t have a trading plan and first order of business: Get a trading plan!

So we need some type of trade trigger to get us into the trade in an objective manner that shows, at least at the point of trigger, that price is in our direction.

Entering Your Trade With A Trigger

I am going to look at three methods to enter your trade and for all the examples, I am going to use the same chart as the last one you just saw. These may not be how the textbooks describe them but often times there is a large discrepancy between trading books and in the field usage.

Market Structure For Triggers

I am a fan of market structure in trading and not only can it signify areas of interest but also are valuable for trade entries. Understand that price moves in waves and in our sample chart, our uptrend needs higher highs and higher lows to remain intact. A down trend would need lower highs and lower lows to stay intact

It would make sense to use the last swing high as a reference point to enter the trade. One price breaches the high after price hits your zone, you could enter the trade.

The issue now becomes position size and risk because it is a large distance between our zone and the high of the last swing. There is a trade-off between confirmation of the move and your stop placement which could leave you with a trade with a very small position size if you are using a % of account risk method.

You can see however that there was not a trade trigger and you would not have suffered a loss on this trade.

Trade Triggers With Indicators

A very objective method of trade triggers is using an indicator cross or turn to alert you to entering the trade. How close you are entering at the turn will depend on the indicator and setting you are using.

This is a 14 period CCI that we can use for a trade trigger. There are a few methods you can use to give yourself an objective trade entry when price enters your trading zone.

- This is where the long shadow shows up and drawing a simple trend line on the highs of the down slopping CCI does not give you a trend line break and therefore no trade.

- Price gives a slight bounce off the zero line but price never makes it high enough to trigger a trade

Waiting for a simple CCI signal would have prevented you from entering a trade after a tempting reversal candle at your trading zone of interest.

To add a little more confirmation, you may want to place a buy or sell stop a few ticks/pips off the low/high of the candles that turns the CCI. This will ensure actual price movement is in your direction although the breach of a high or low of a single candle does not hold much significance.

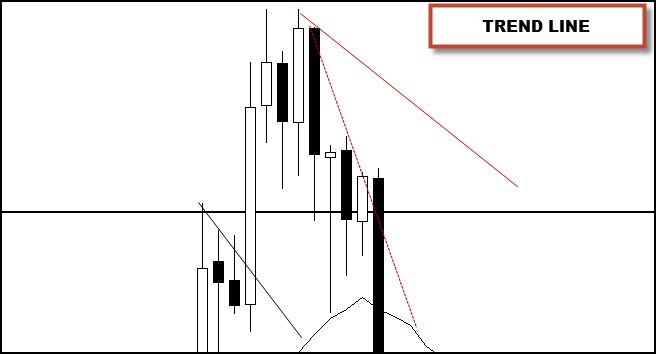

Trend Line Break Trade Triggers

Trend lines are used by many traders to help define trend direction and even trend strength through the use of fanning trend lines. The way you use them to define the main trend is also how you can use them to show a break of the counter trend move or retracement.

The chart we have been using makes it difficult to use a trend line at this point because you want to connect swings and there are no swings to speak of at this point.

There is another way to draw trend lines and that is simply having the line hug the the shadows or extreme of the body candle range.

The black trend line is an example of just connecting the upper shadows and entering the trade on a strong break of the line.

The solid red trend line is plotting off the highs and the dashed red is an attempt to join the high with a sloppy swing high.

Regardless of the reds you used, there was not a trigger when price entered the trading zone.

Trigger Drawbacks

Nothing is guaranteed but having an objective means to enter a trade keeps all emotions out the trading equation and that is a huge step for many traders.

- When trend lines break, there is often a retest of the lines and that can cause many traders to panic out.

- Support/resistance can be arbitrary and often times we will see price test (break the high), fail, and then drop after you are in the trade.

- CCI is one step removed from current price as it needs price to calculate.

In the end, what really matters is that whatever you use is something you are comfortable with and will be consistent with. There are many ways to swim a river and the same is true for trading: There is no one right way to trade.

This objective way to enter trades takes emotions out of the equation and further cements an objective trading style where your rules do what they are designed to do.