- July 21, 2020

- Posted by: CoachMike

- Categories: Options Trading, Swing Trading, Trading Article

Knowing when to close out of a trade can be challenging when the markets are constantly moving back and forth.

Holding on to a trade too long or not long enough can lead to inconsistent returns.

When buying long call or long put options the key to remember is you are holding a ticking time bomb.

Every day that passes those options will lose value. In order to make money you need the stock or ETF to move in your favor quickly.

If the move takes too long you will be left with a much smaller return, or even worse, no return at all.

Our Guidelines For Closing Options Trades

When buying options (long calls, long puts, debit spreads) we like to follow the criteria below:

- Trade options that have 30-60 days left to expiration. These options will give you more time for your directional assumption to play out and will also typically provide the best volume in the options.

- Look for the stock to move within the first 10-15 days of placing the trade. Remember we need a quick move to take place in order to make money.

- Target 70-100% returns on long option positions. Don’t feel like you have to swing for the fences on every trade. Booking 70-100% returns on a long option position will allow for really impressive growth in your account.

- Limit risk to 50% of the cost of the option. Limiting the damage on a losing trade is crucial to successful trading long term. We know there will always be winner, losers, and breakeven trades along the way. If we can make sure our winners are larger than the losers, we will take a tremendous amount of pressure off our winning %. We won’t need to win 90% of the time to make money.

When selling vertical spreads we like to follow the criteria below:

- Trade options that have 30-60 days left to expiration. These options will give you more time for your directional assumption to play out and will also typically provide the best volume in the options.

- We are able to hold the trades longer when using credit spreads due to the time decay helping us. Every day that passes is a good thing. Credit spreads will typically need 15-25 days to hit our desired profit goals.

- Target a 30-50% return on capital when using credit spread positions. While holding all the way to options expiration can lead to bigger profits, it also ties up our capital for a longer stretch of time. We find that by closing out of trades early when we can keep between 50-75% of the premium collected to sell a spread that will give us the best results long term.

- Limit risk to 70% of the max loss on a losing trade. Limiting the damage on a losing trade is crucial to successful trading long term. We know there will always be winner, losers, and breakeven trades along the way. If we can keep the losses smaller than max loss it will take the pressure off our winning %.

While the guidelines above provide a nice road map for managing your options trades, it can also be very helpful to have a trading system in place that provides technical levels on the charts to follow.

For example, when identifying our options trades at NetPicks we use a set of indicators that provide our entry points and stop points to the penny before we ever get into a trade. This allows us to stay disciplined to a rule set that we know will put the numbers in our favor long term.

Whether you are using a custom trading system or following our trade management guidelines above, the key is to have an approach in place that you can stay disciplined to.

If you keep your risk small and follow the trade management guidelines you will be well on your way to creating a consistent source of income.

Before you can exit an Options trade, you have to know the basics of Options trading.

Options 101 Review

Having an understanding of the options basics will allow to make trading decisions with a much higher level of confidence. An options contract is a known as a derivative. A derivative is linked to some other security like an individual stock, Index, or ETF.

An option’s performance is reliant on the underlying asset’s performance.

- Stocks

- Index Products

- ETFs

Trading options on the products listed above will allow you to create a consistent source of monthly income. The beauty of trading options is they allow us to take these trades with defined risk.

Buying and selling options takes some of that risk away while still allowing you to make a substantial amount of money. You just need to have a defined system in place that puts the odds in your favour over time.

Options can also protect you when you want to invest in a stock or other investment assets, but you are not sure about the future and want to safeguard your portfolio’s profitability.

Types of Options

An option is a contract that allows you to buy or sell an asset like a stock or ETF at a fixed price before the contract end date. The key point here is that an option allows you to buy or sell before the end date but does not require you to buy or sell.

There are two types of stock options.

- Call Options

- Put Options

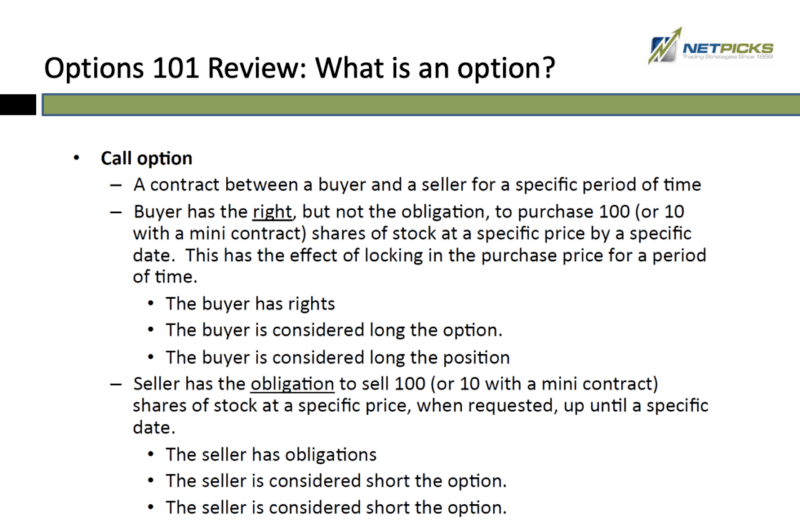

Call Options:

When you buy a call option, you have the right but not the obligation to buy 100 shares of stock at a certain price by a future date. The call option will increase in value as the stock moves higher.

This provides you with unlimited profit potential on the trade while limiting the risk to the price paid for the option to open the position.

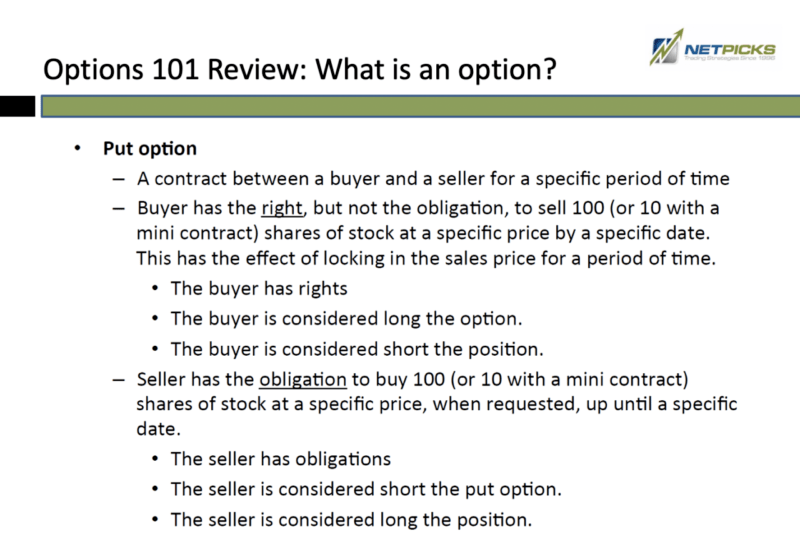

Put Options:

When you buy a put option, you have the right but not the obligation to sell 100 shares of stock at a certain price by a future date. The put option will increase in value as the stock moves lower. This provides you with unlimited profit potential on the trade while limiting the risk to the price paid for the option to open the position.

Parts of an Option

If you are going to trade options successfully, you need to know and understand the different parts that make up an option and how they work.

- Strike Price

- Premiums

- Expiration Date

1. Strike Price

The strike price is the price at which you are willing to buy or sell your option.

In a call option, this is a price where you can buy the stock or asset during the life of the contract. If the price of the stock or asset goes above the strike price before the expiration date of the option, you make a profit.

In a put option, this is a price where you can sell the stock or asset during the life of the contract. If the price of the stock or asset goes below the strike price before the expiration date of the option, you make a profit.

2. Premiums

When you buy either a call option or a put option, you have to pay a price. The amount you pay to act on that option is called a premium. The premium paid to buy the option is your max risk when you buy an option.

Remember, when you buy or sell an option, you are not actually buying any of the underlying asset. Instead, you are buying the right to buy or sell underlying asset at a later date. The premium is the price you pay for that right or option.

When you purchase a call option, you are looking for the price of the underlying asset to increase over your strike price. If it doesn’t increase in value, then your loss is limited to the price that you paid for the option.

- Intrinsic Value

The intrinsic value of an option is based on the current market price of that stock or underlying asset. When the value of the stock or asset is greater than the call option’s strike price, it is considered in the money. When the value of the stock or asset is lower than the put option’s strike price, it is considered in the money.

The intrinsic value of an in the money call or an in the money put is calculated differently.

For an in the money call option, the intrinsic value is the market price of the underlying asset minus the strike price.

For an in the money put option, the intrinsic value is the strike price minus the market price of the underlying asset.

On the other end, if a stock loses value below the strike price of the call option, it is considered out of the money. When trading put options, they are considered out of the money if the stock rises above the strike price of the options. Because stock options that are out of the money have no profit, their intrinsic value is zero.

- Time Value

Options are decaying assets meaning they lose a little of their value for every day that passes. As an options buyer you want the stock to move in your favour as quickly as possible to overcome the time decay that adds up daily.

When selling an option, the time decay is your friend. Every day that passes allows the options to get cheaper which in turn allows you short options position to make money.

Time decay moves in a non-linear fashion meaning it is not equal for every day that passes. As an option gets closer to its expiration date, the daily time decay becomes more significant.

When an option reaches its expiration date, it is worthless. Investors are willing to pay more for an option that allows the underlying asset to grow in value. The farther away from the expiration date the option contract is, the greater its potential for growth. The greater the time value in an option, the greater the cost of the option’s premium.

The closer the stock option gets to the expiration date, the less value it has. This is called time decay. As the time value decreases or decays, the price of the premium is based more on the intrinsic value of the asset or stock.

- Expiration

Options have a defined life span and will expire once they get to the end of that lifespan. The lifespan of the options contract is referred to as its expiration cycle. Options are most often traded in weekly and monthly expiration cycles.

Weekly options will expire each Friday and Monthly options will expire on the 3rd Friday of every month.

If you buy a put option, you have until the end of the contract’s expiration date to sell the stock at the agreed to price. If you don’t act on the option and it expires, the contract will now be worthless. As a buyer of that put option, you don’t own the stock option or any shares of stock. Financially, all you have lost is what you paid for the cost of the premium.

If you buy a call option, you have until the end of the contract’s expiration date to buy the stock or asset at the agreed to price. If the stock price falls during the term of the contract, you can sell the options at the market price or let it expire. Again, what you have lost is the cost of the premium you paid for the stock option.

Purchasing Multiple Options Contracts

When you buy an option, it is not like buying a stock, bond, ETF, or any other investment. You cannot buy just a single share when you buy an option. Options represent 100 shares per contract.

This means that whether you are buying or selling, you need to multiply your cost or profit by 100. Therefore, whenever you calculate your expected profit or potential loss when purchasing an option, you need to add in the amount of the premium and multiply it by 100.

So, if you buy a call option of ABC company at $5.00 per contract, your premium cost will be $500 ($5.00 x 100).

Pros and Cons Of Trading Options

While the concept of buying and selling options is fairly straight forward, planning your strategy so that you can maximize your profit and minimize your losses, is more detailed.

As with anything, option trading has its advantages and disadvantages. Before you decide if you can make a living selling options, you need to consider both pros and cons carefully.

Pros of Trading Options

- Fewer Upfront Costs

- Less Potential Risk

- Flexibility

Fewer Upfront Costs:

Options require much less upfront costs. If you were to buy 100 shares of ABC stock at the market price of $500, you would need to invest $50,000. If you were to buy a call option of the same stock for a premium of $5, your investment would be only $500 ($5 premium X 100 shares).

This can be very appealing to retail traders working with smaller account sizes as it opens up the ability to trade some of the higher priced tech stocks with far less capital.

Less Potential Risk:

When you buy an option, your risk is limited to the price paid for that contract. You can be dead wrong on the directional move of the stock and still limit your risk to the cost that you paid for the contract.

When selling an option as part of a vertical spread your risk is limited to the difference between the strikes minus the credit collected to put the trade on. Again, you are able to control 100 shares of stock with this trade for a fraction of the cost when compared to buying/selling the shares of stock.

Flexibility

There are option strategies that will allow you to make money in multiple different ways. You can make money from a builish, bearish, or choppy market. They are the most flexible financial product in the world.

The Cons of Trading Options

- Complicated to Learn Strategies

- Potential for Increased Loss

Complicated to Learn Strategies

While understanding how stock options work at a very high level takes a little patience and understanding, it can be done fairly easily. Trading simple call and put strategies can be easy to pick up. However, there are other strategies like vertical spreads that can get more complex can intimidate easily with the different terminology.

Potential for Increased Loss

If you don’t fully understand the risk involved with using different options strategies, it can lead to large losses quickly. Getting caught up in the profit potential that comes with using certain options strategies, it can be easy to lose sight of the risk involved.

We teach our students at NetPicks to only use risk defined options strategies which will help avoid the large losses.

1 Comment

Comments are closed.

[…] and uptrend investors. When there is a failed breakdown or breakout stage, it is time to exit a trade, picking your profits or losses, and wait until the price exceeds the low of breakdown or the highs […]