- January 7, 2017

- Posted by: CoachShane

- Categories: Basic Trading Strategies, Trading Article

Humans are programmed to like certainty. We’ve all had times where something that “should” have happened doesn’t and we all know that feeling of annoyance that creeps up. If what happens is something we really didn’t want, well, annoyance blows into anger for some.

Why do we get annoyed? Because when something happens outside of our control, it attacks the very thing that humans like; control. Look around you – the human race has devised an infinite numbers of devices and contraptions with the idea of controlling the previously uncontrollable.

For traders, things that occur outside of our control usually costs us money and that, combined with the annoyance of not being in control of the price movement, sets us up for an extremely difficult time emotionally wise.

Trading Uncertainty Is Reality

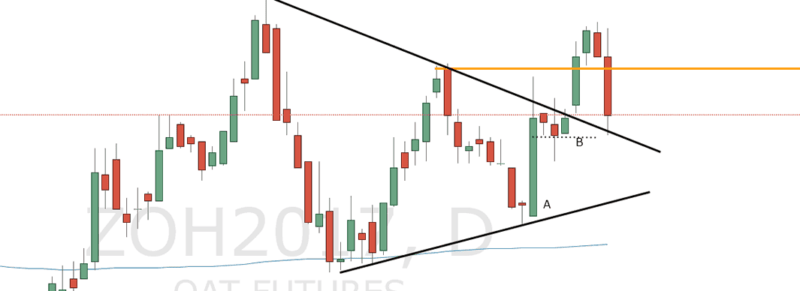

No matter what you think you know in trading, the market is going to move whichever way holds the majority of the imbalance. A recent example is in Oats Futures. Someone I know what talking about the recent strong moves on volume in Oats even citing the break of the 200 dma and the break of consolidation as a strong bullish sign. He took a long position in this market and talked the position up.

It was as if he had a strong degree of certainty in the move and given his analysis, it did have some merit.

As for control? There is none and every trade entered must be done with the certainty that the certainty of your analysis does not exist. Mine take was different.

You can see the chart shows the move and the break of consolidation does appear to be strong. There were a few things that had me question the chart:

A. Strong move from the bottom of the pattern right to the top, for me, is not a good sign of continued momentum after the break

B. A consolidation below supply line and at the top of a momentum candle does speak to a continued move.

Price is also approaching a high that was a sound price rejection better seen on the weekly chart. For me, this is a low probability play that must be tightly managed especially at highs.

- I didn’t take the trade at “B” although it turns out it would have given some profit.

- He took the trade and managed a small profit.

Both of us had to live in the world of uncertainty and be comfortable with it. If he would have been certain that this was going to run, he may have risked more or just ignored the chart until a profit target was reached. If I was certain it would be a failure and now proven wrong, I’d be kicking myself because the control I thought I had…the certainty of failure…would have been bowled over by his profits.

Could that lead me to take a revenge trade? In the past it would have.

Can Your Recognize Your Problem?

The lack of ability to deal with the uncertainty effectively isn’t always acutely obvious and often has a progression of behavioral stages. What frequently happens when traders cannot cope with uncertainty is that they struggle to take legitimate setups when they occur as they are unconvinced they will work.

But time and time again, they see these trades go on to work out. They then become more susceptible to taking trades which are sub-optimal – partly through frustration and partly through not wanting to miss out.

Inevitably these trades are less likely to work. Once in a trade (which by now a trader has convinced themselves of the fact that it will be a winner) profits are taken early (the need to make the trade a winner and thereby prove the trader’s original conviction) and losses are held beyond reasonable levels (because taking a loss confirms that a trader’s original idea was undeniably wrong).

In the former case the trader feels silly for having exited early, but the conviction of being right about the trade is cemented. The latter tends to create feelings of betrayal and mistrust that clearly are not conducive to effective trading.

9 Ways To Deal With Uncertainty

- Have no doubt what a trading setup looks like and what its ETS are (entries, targets, stops). By having a clear picture of how you trade, there is no room for ambiguity – you know when you have a trade and you know when you don’t.

- Simplify your method to what you can handle. Involve too many variables in a strategy and you’ll lose clarity in the moment and find that you are nervous about taking trades.

- Be aware of and accept anxiety about a trade, but do not let it control your actions.

- Rate yourself on how well you’re following your trading plan not and not on the actual results. Of course it’s also important to track the theoretical performance of your plan, as trading a strategy you know is a losing one won’t last and will create other problems. Your actions are controllable but the opportunities that the markets present are not.

- Really work on getting the whole “probabilities in trading” thing. It’s not about finding the most likely strategy to win – in fact there are plenty of profitable systems out there that have pretty unspectacular win:loss ratios. It’s about adapting your mind to accept the chances of taking a loss and embracing that risk.

- Be humble and accept your own fallibility – it’s important to work on trying to eliminate the majority of your mistakes, but you are still human so the odd mistake is inevitable. Also accept that you can act correctly and still come out with a losing trade. Probabilities again.

- Don’t be under-capitalized. Having a small trading account really creates a huge psychological problem that somewhere down the line you’ll have to deal with. A small account can get you going, but if you’re trying to make money, very trade takes on an unreasonably high degree of importance and inevitably fosters an undesirable attachment to outcomes.

- Surrender to the market and don’t try to win or not lose. Do your work and accept that the outcome on any single trade is unknowable.

- Meditation and exercise help reduce stress. Stress is a huge factor in allowing emotional judgments to take over from logical judgments and it is often generated in situations where we feel uncertainty or we have lost control (even if we never really had it anyway).