- September 10, 2024

- Posted by: Jay Soloff

- Categories: Options Trading, Trading Article

In options trading, there are many strategies, each with its own set of nuances, risks, and rewards.

The Delta Neutral Income Strategy is a sophisticated yet accessible method for generating consistent returns while managing risk.

I don’t care if you’re a seasoned trader or new to options, understanding and mastering this strategy can add a valuable tool to your trading arsenal.

In this article, we’ll explore the ins and outs of the Delta Neutral Income Strategy.

We’ll explain the mechanics, Highlight the benefits, expose the risks – and how to mitigate them, Plus show you how exactly to implement this options strategy.

What is the Delta Neutral Income Strategy?

At its core, the Delta Neutral Income Strategy is an options trading approach designed to generate income while minimizing exposure to directional market movements.

In other words, this strategy creates income, while the stock is flat or only moves a little bit.

| Aspect | Description |

|---|---|

| Strategy Name | Delta Neutral Income Strategy |

| Purpose | To generate income while minimizing exposure to directional market movements. |

| Market Condition | Effective when the stock is flat or experiences minimal movement. |

| Delta Definition | Delta measures how much an option’s price is expected to change based on a $1 move in the underlying stock. |

| Delta Example | A delta of 0.5 means the option’s price changes by 50 cents for every $1 move in the underlying asset. |

| Delta-Neutral Position | Balances positive and negative deltas across different options to reduce sensitivity to price changes in the underlying asset. |

| Execution | Involves a combination of buying and selling options. |

| Income Generation | Collect premiums from selling options while using purchased options to hedge against potential losses. |

| Income Stability | Provides steady income regardless of market direction (up, down, or flat). |

Delta is a measure of how much an option’s price is expected to change based on a $1 move in the underlying stock. A delta of 0.5, for example, means the option’s price will change by 50 cents for every $1 move in the underlying asset.

A delta-neutral position balances positive and negative deltas across different options so that the portfolio is less sensitive to price changes in the underlying asset.

The strategy typically involves a combination of buying and selling options. You collect premiums (income) from selling options while using the purchased options to hedge against potential losses.

This way, you can earn a steady income regardless of whether the market moves up, down, or stays flat.

One of the most popular delta-neutral options strategies is trading Iron Condors… Check out this great article: What Is an Iron Condor Spread?

Time Decay

Professional traders love their “Greeks”…

And one of the big Greeks with delta-neutral strategies is Theta or Time Decay.

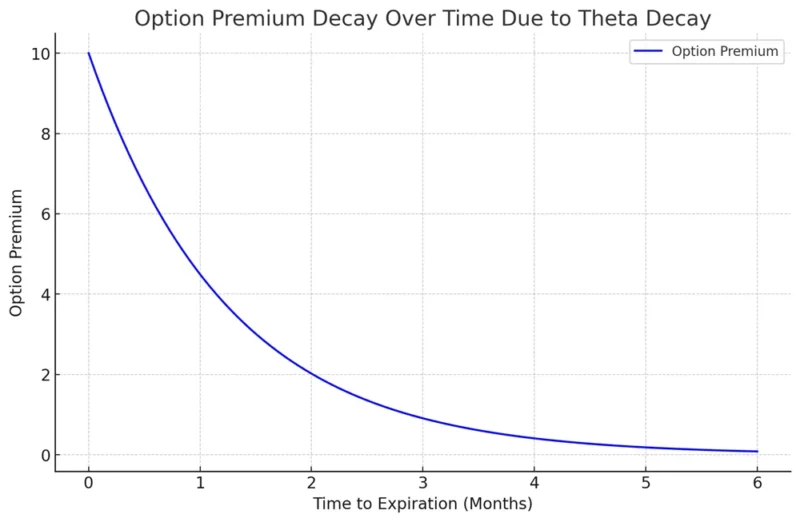

Theta is the rate at which the value of an option erodes as it approaches expiration. With Delta Neutral Strategies – they often involve selling options, theta becomes a source of profit.

As time passes, the options lose value… creating an income stream from the time decay.

Here’s the key… The closer the options are to expiration, the faster this decay happens, enhancing the strategy’s profitability.

This makes Delta Neutral Strategies with Time Decay appealing to all traders.

Why would I Choose a Delta Neutral Income Strategy?

The Delta Neutral Income Strategy offers several compelling advantages.

The core benefit is Income generation. These trades are designed to create streams of income by selling options. Your profits are locked in from the beginning.

Another benefit is risk management.

When the trades are established correctly, the strategy mitigates risk and you have a known maximum loss.

The strategy is also flexible… you can craft the delta neutral strategies, Like Iron Condors, to the condition of the markets.

Traditionally, these trade types are best when the market is range-bound or there’s low volatility.

However, If the markets are trending in one direction, you can shift that part of the options setup slightly farther out to account for anticipated moves.

Finally, Capital efficiency is a huge benefit in these trade types.

With Delta neutral trades, because your risk is defined, you will face lower margin requirements than with an unhedged position. That means you can place more trades with the same amount of capital – all things being equal.

Advanced Techniques for Delta Neutral Income Strategy

Here are some techniques that allow for more nuanced strategies that can adapt to different market conditions and offer additional income opportunities.

Gamma Scalping

One such technique is gamma scalping, which involves actively managing the gamma of your position to profit from small price movements in the underlying asset.

Gamma measures the rate of change in delta as the asset’s price shifts. When you have a positive gamma position, your delta will increase as the asset’s price rises and decrease as it falls.

By buying or selling the underlying asset to offset these changes in delta, traders can lock in small, frequent profits. This technique requires close monitoring and quick execution, making it best for seasoned traders who watch the markets constantly.

Calendar Spreads

Calendar spreads, also known as time spreads, are another approach that can be integrated into a delta-neutral strategy. This involves buying and selling options with the same strike price but different expiration dates.

By leveraging the differences in time decay between short-term and long-term options, traders can generate additional income while maintaining a delta-neutral position.

However, this strategy requires careful management, as fluctuations in implied volatility and the underlying asset’s price can significantly impact profitability.

In addition to these, Iron Condors and Iron Butterflies are popular strategies that can also be aligned with a delta-neutral approach.

Both strategies involve selling options spreads with clearly defined risk and reward profiles. You can use these strategies to enhance your income generation while keeping your positions balanced.

Ratio Spreads

Ratio spreads are another advanced technique that involves buying and selling options in an unequal ratio, such as selling two options for every one option bought.

This strategy can be particularly useful for generating additional income while maintaining a delta-neutral stance.

For example, a trader might sell two out-of-the-money (OTM) calls and buy one in-the-money (ITM) call. This creates a position that benefits from a slight increase in the underlying asset’s price but remains neutral if the asset’s price doesn’t move significantly.

However, ratio spreads require careful management, as a big move can increase your risk.

Incorporating these advanced techniques into your portfolio may allow you to generate steady income while maintaining strict control over risk.

How you can master the Delta Neutral Income Strategy

In a nutshell, you can master a delta-neutral strategy by picking ONE options strategy and learning it like the back of your hand.

I like the Iron Condor Options strategy – it’s delta neutral, creates regular income, and has easy-to-understand risk profiles.

Like any trading strategy, you need discipline, patience, and a willingness to learn and adapt.

It’s how you become a better trader.

Want to Learn More About Iron Condors?

Like I said – Iron Condors are my favorite Delta neutral strategy… HOWEVER, there are millions of nuances to trading Iron condors.

For example, reviewing the underlying stock, and developing a solid projection of its volatility can be critical.

Get this right, and you print money… get this wrong and you’ll see loss after loss.

I want to give you a leg up on Iron Condor trades. I’ve assembled a list of my 10 favorite stocks to trade Iron condors. It’s a great place to start if you’re looking for consistent income with limited risk.

Click here to get “The Top 10 Stocks for Iron Condor Trades” – Free