- May 28, 2021

- Posted by: CoachShane

- Categories: Advanced Trading Strategies, Trading Article

Trends lines have always been a popular way for technical traders to define support and resistance levels in all markets. The key to being able to use a trend line efficiently is to ensure you have a rules based method to draw them consistently.

What Are Trendlines?

Trend lines are levels used in technical analysis to represent either support or resistance, depending on the direction of the trend. They are analogous to horizontal support and resistance.

Markets go up, down, sideways and when a market is trending, looking at the impulse and corrective swings can tell you the strength or weakness of a trend.

When a market is trending up, we expect to have impulse moves larger in length than the corrective declines against the trend. This shows that the demand is still high for the particular market.

When people who were interested in buying thin out, the impulse moves get shorter and less frenetic. The size of the corrections may increase.

There will come a time when the buyers are done and supply enters the market. When this occurs, we will start to see the correction larger in scope than the impulse moves.

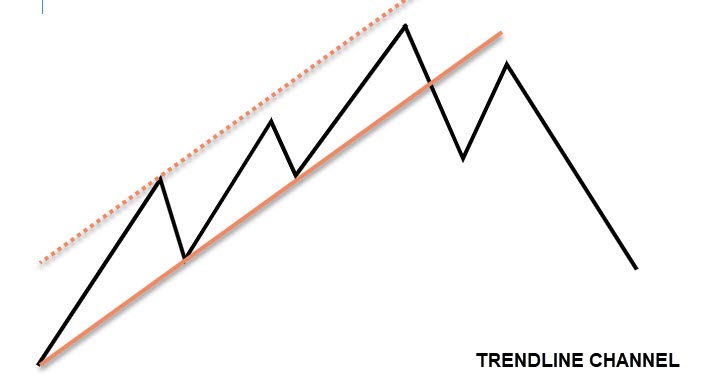

This graphic shows the typical uptrend in action. Large thrusting impulse moves with smaller corrections.

Notice when we see larger corrections that either sellers are stepping in or buyers are unloading their positions. Either way, it’s possible we will see smaller impulse moves. In our example graphic, we see a lower high and then a new lower low is put in.

Being in tune with the swings in this example can give you a “heads up” to either lighten a position, take a quick scalping trade or to refrain from entering any new long positions. Once momentum to the downside occurs, this may be the time to exit a position.

The next image shows a trend line trading technique of connecting the lows which can help you determine when a change of state in the market has occurred.

This does not mean a trend change but is a visual clue that at this point in time, what was a steady uptrend has met some strong selling.

After the trend line breaks, we could:

- See a retest of the highs

- See a test of the trend line

- A consolidation could begin

- A complex correction takes place which is a two legged pullback.

You can also clone the bottom trend line and place it on the highs.

This is called a trendline channel where the top line is used to measure momentum. Once the upper line is broken, traders will either look to short the market or play reversals after the breakout pullback price move.

Fanning Trendlines

As discussed earlier, we can see large price moves that can result in the current trendline being too far from current price. These can be very tricky as some traders may look at it as intense interest in the market and look to position in the direction of the break.

Other traders will look at the same move as being out of the ordinary advance of the trend and stand aside thinking we have a climax or exhaustion move in the instrument.

Consistency matters when drawing trendlines and one rule to consider, in the case of a downtrend, is to connect the last high into the lows.

This ensures the relevant swings are being used and can also give you a steeper trend line that is in tune with the market rhythm.

This ensures the relevant swings are being used and can also give you a steeper trend line that is in tune with the market rhythm.

You can see that you also get an earlier trend line break while keeping in tune with price action.

Keys To Drawing An Effective Trendline

There is no hard and fast rule when it comes to drawing a trend line correctly but you should have a consistent method of choosing the lows or highs you will use in their construction.

The first key is you need to have at least 2 points to begin a trend line.

Two easy to find points ( I also included a lower channel connecting the swing lows) and extended to the right. Is there a price pattern you can see at the third touch to initiate a trade?

Two easy to find points ( I also included a lower channel connecting the swing lows) and extended to the right. Is there a price pattern you can see at the third touch to initiate a trade?

If not, the pullback to the upper line is a short term uptrend. We can draw a trend line on that.

Traders can play a break of the up trendline and place their stops over the high. We will then see the current trend continue to the downside.

Traders can play a break of the up trendline and place their stops over the high. We will then see the current trend continue to the downside.

Pretty versatile trading tool.

Use higher time frame for trend line swings

On lower time frames, we can get many highs and lows while there are generally less on higher time frame charts.

On this daily chart, you can see that breaks of higher time frame lines can lead to bigger moves in the opposite trend direction.

Why? Time.

The more time it’s in place, the more time other traders are able to see the same zones as you. The more traders involved, the better the reaction will be.

Once we start to get above daily charts, we can then use trend lines for targets.

This chart is a daily chart and using a weekly trend line.

You can see we fanned trend lines as the uptrend continued. As price was reaching the zone of the weekly trendline, we began to see resistance set in.

Price rejected up into the trend line until price eventually gapped over it.

Try not to cut through candles.

There are some that will say that cutting through candles is ok but that will disregard the tips of swing highs and lows at times.

Do those matter?

They certainly do if you got stopped out at those tips so they should matter with your drawings.

This example shows an irrelevant trendline. If a trader played the break to the upside, they are quickly taken out of that trade.

This example shows an irrelevant trendline. If a trader played the break to the upside, they are quickly taken out of that trade.

This is ties into another tip….

Ensure the last swing into lows or highs is connected.

Notice the difference between the last two graphics.

Notice the difference between the last two graphics.

While a break of the trendline entry would have had you under water, there are areas where price gives you trade management areas.

You will also note that the pullback after the break, stops in the zone of the trend line giving you an opportunity for an entry.

1-2-3 Reversals With Trend Lines

This is a good rules based approach to trend reversals and comes from Vic Sperandeo.

In this example, we are using a 60 minute time frame chart.

In this example, we are using a 60 minute time frame chart.

- Price puts in a high and begins to pull back

- Price breaks the trend line to the downside

- We see price test the backside of the trendline trying to retest highs and fails.

Once price breaks the low at 2 and holds, you can consider a down trend is in place.

Keep in mind this will look different depending on the time frame. On a higher time frame, we may not get a retest that is as obvious as this one. We also may get a break further down in the pullback.

This is why it is vital for you to know your timeframes you will trade.

On a one hour chart, this may be a leading to a two legged pullback and will resume the uptrend.

On daily chart and above, this could be a complete change of trend.

A Few Simple Trend Lines Can Equal A Strategy

There are so many ways to design trading strategies using trend lines.

It all starts with your consistency in drawing them. Learning to consistently draw trend lines is a skill you can easily master. It’s one thing though to master a technique but a different world to execute in real time.

Trend lines are certainly not foolproof but can give you zones where you can look for reversals/continuation of price to set yourself up in a trade.

Practice either of these ways of consistently applying a trend line and then spend the chart time to see how price reacts when it finds itself meeting one of them