When trading with Fibonacci levels (fib levels), remember they are just a tool and like any tool and any type of trading system, the usefulness depends on the user and the rules they follow in their application.

I am going to fully show you a simple way to trade with Fibonacci levels so you can start practicing your technique today.

You have probably heard that the main knock of Fibonacci targets is: “place a bunch of Fibonacci retracements and extensions on your charts and some are bound to act as support and resistance levels”.

While that may be true, there are several ways that may help you get a handle on Fibonacci retracement trading to find potential reversal points on your chart.

What Is The Fibonacci Sequence?

We can thank an Italian mathematician named Leonardo Pisano Bigollo, for bringing Fibonacci to the world.

A Fibonacci retracement is based on ratios derived from the Fibonacci sequence. The sequence is formed by adding the prior two numbers together to form the next.

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610…

As numbers go higher, the ratios of n:n-1 and n:n+1 (where n = any number in the sequence) approximate 0.618 and 1.618 respectively. This is often referred to as the Golden Ratio and it can be found, along with derivatives of it, throughout the natural world.

0.382 is 1 – 0.618 and these two numbers along with 0.5 make up what we recognize as the most common format of the Fibonacci retracement drawing tool.

Additionally, there are some derivative ratios that are frequently used. The square root of 0.618 gives us a common 0.786 value. The inverse of the square root of 0.618 gives us a common extension value of 1.272.

There are other ratios, but these are, at least in my book, the main ones. You should search out the best best book on fibonacci trading if the background is interesting to you.

Using Fibonacci Retracement Levels

A retracement in trading is where the price will rally or decline to a potential support or resistance zone and using Fibonacci retracements, you can find potential levels where price will stop.

Taking a step back, ask yourself what are these levels representing? For me, they are a measure of human behavior and are a framework to understand emotional extremes.

Given how I look at the representation, I look to the overall move, the obvious swings (can be subjective) and also to pockets of consolidation.

The key to identifying where precisely to draw a Fibonacci retracement comes down to the same thing as using any drawing tool or technical indicator – they must be used to investigate something specific about the market and not purely point A to point B.

What I mean by this is that the tool is most effective when it’s applied to a move created by something. This could, for example, be a big move generated by an economic event (e.g. NFP, FOMC) or even one stemming from a change in state (e.g. a thrust as a market breaks out of balance).

My mentor when I was learning the basics of Fibonacci would also use thrust bars and gaps which show where extreme action resides.

The retracement levels I use from the Fibonacci sequence are 38.2 and 61.8 because less clutter on the chart will show you the most important variable – price.

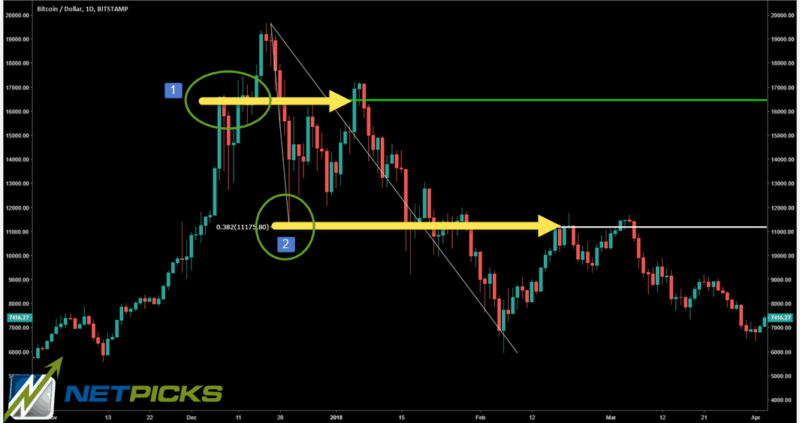

Let’s go through a simple example using Fibonacci retracements to find resistance in a down-trending market – BTCUSD

FIBONACCI RETRACEMENT LEVELS – DOWN TREND – BITCOIN

- We start the Fibonacci retracement by pulling from the highest high on the Bitcoin chart

- Ending at number two, the levels 38.2 and 61.8 are plotted on the chart (the 38.2 has been removed for this example – the 38.2 is for the next example)

- Price retraces up to the 61.8% Fib level and using your entry method, you would short this market

- Using the extreme high again, we have a Fib pull ending at….

- Ending the Fib pull here, Fib levels are plotted and for this example, we remove the 61.8% level

- Price rallies into this zone present a double top, and then price collapses

This is a simple example of using Fibonacci retracements and you may see a confluence of other factors on this chart.

FIBONACCI CONFLUENCE

- This yellow arrow is highlighting a former resistance level that breaks as price puts in the highest high. Carried over to the right, this zone lines up with the Fib level

- This area is the support area we pulled the first Fib to and you can see, carried over the right, price stalled in the confluence zone

As I said in the beginning, the biggest knock of Fib levels is that a bunch of lines will get hit by random price action.

To use Fib levels as a framework helps you zone in on certain areas and then find supporting structure as indicated in the two charts above.

Fibonacci Confluence And Price Action

Fibonacci retracements do not need to be used as entry levels in order to be useful. Context alone can make them very useful.

However, there are times where a specific retracement may, in fact, qualify as an entry zone.

It is important to remember that these levels don’t necessarily act as red light/green light levels. A market can definitely move a few ticks beyond a fib retracement level and it still is valid.

However, there are times when if there are multiple technical factors in close proximity to a retracement price, it could, in fact, be a good area to look for an entry (context permitting).

For example, you might find that when you draw your Fib, the 38.2% retracement of a thrust higher, aligns with a trend line and the session open. In this case, if there’s been a rejection of lower prices, it may be an opportune area to lean on in looking for a long entry.

How To Use Fibonacci Expansions In Your Trading

An expansion is a measurement of the impulse leg of a move projected from the correction leg. To plot a Fibonacci expansion, you will use the Fibonacci expansion tool that requires three clicks and I use the numbers .618, 100 and 161.8% as I was taught.

We can use expansions in a number of ways but the most popular way is to find profit targets using the Fib ratios.

FIBONACCI EXPANSIONS FOR-PROFIT TARGETS – FOREX FUTURES EXAMPLE

This is the Yen futures chart and in this case, we are using the green circles starting at the left, going up, and then pulling the third click to the last green circle.

The expansions are plotted and what is interesting is the 61.8% lines up with potential resistance and in the end, price tops out at the 100% expansion level.

Using Expansion To Find Symmetry In The Market

One thing you may have seen is how price seems to move in waves not much different than the ones that came before it. In some cases, swing in price has been the exact same length in terms of price which makes symmetry something to consider.

You can measure the distance of one swing and project that swing to another swing and look for the 100% level which shows symmetrical pullbacks in price.

MARKET SYMMETRY – MEASURING SWINGS

This is the daily chart of wheat futures and the market is in an uptrend. Here is how we plot the yellow lines:

- First click at the swing high

- Lowest swing low after the swing high at one

- The leg price distance from 1-2 is projected from 3 which gives us the first yellow line. You would determine a trade entry in that location

- This is where the first measurement ended and we can also use the 3-4 leg and project from number five

- This high also contains that measure from 1-2 projected from five and 3-4 project from five

With the last horizontal line set, we are using the distance from two corrective swings and projecting from the highest high to give us an idea where a potential support level can be that will stop the price retrace and give us a bounce to the upside.

Just like the lines plotted by Fibonacci retracements, these zones are potential reversal points where you could look for trading entry.

100% Symmetry Breaks Can Be A Red Flag

The symmetry measures previous swings in the market and is a good read on the current volatility in terms of pullbacks.

If pullbacks are too strong or further in distance than previous pullbacks, you may determine that something has shifted in the current trend direction.

Here is an example of using symmetry to determine a shift in the dynamic of the market.

- This white line is projected from the number three high

- Current price location has retraced from the highest high to virtually the same price distance as we see at number one

- This begins a smaller measure, the green line, and is projected down

- Price has broken this level which would have been the end of a complex correction in this stock.

What we can determine in NKE is that something has shifted in the dynamic of this market. Complex corrections have broken and we have retraced the distance as the largest pullback in the near recent price action.

But the price action, the large momentum candlesticks, are hinting that something has changed in this current retrace in price.

By using the symmetry feature, we can either remove ourselves from a strong bullish stance, be prepared to exit a position, be prepared to reduce risk.

Develop Your Fibonacci Trading Strategies

Using Fibs to determine potential pivot points in the market can help you frame price action and ensure you are looking to trade at specific locations on the chart. There is nothing magical about Fibonacci ratios and they are hard to backtest given the subjectivity that can be involved.

You can design a trading strategy that takes into account:

- Trend direction – using a moving average as an example

- Retracements in price

- Symmetry measures where breaks in symmetry are a red flag

What is vital is that you understand that Fibs are just measures of price movement and that markets move in a rhythm.

If the rhythm is broken (think symmetry) then something has changed in the market and you should understand what that is.

If you look for a big move that has some kind of significance, how the market reacts to Fibonacci retracement levels can give you a great idea of the energy the move really contains and whether a continuation is likely or not.

Once you figure out what’s going on relative to a strong move, it’s not too difficult to come up with a way to make money from the subsequent action.

If you don’t have a defined way of using the Fibonacci retracement tool, you’ll be likely to start measuring ranges and by doing this, you’ll lose the ability to assess how the market is reacting to the initially attempted direction.

Pullbacks are a common market mechanic and the Fibonacci series is just a measure of the pullback. What should be clear is that using Fibs alongside market structure is much better than relying on the Fib lines themselves.