- November 15, 2023

- Posted by: CoachShane

- Categories: Options Trading, Trading Article

Credit spreads, a trading strategy involving the selling and buying of options with different strike prices within the same expiration cycle, offer traders an opportunity for consistent income generation while effectively limiting potential losses. This strategy’s primary aim is to maximize profit, defined as the net premium received, while minimizing risk, making it a great choice for income-focused traders seeking financial stability in any economic climate.

In this article, we will explore the fundamentals of credit spreads, their risk-reward profile, and the strategies to harness their potential for reliable income

In this article, we will explore the fundamentals of credit spreads, their risk-reward profile, and the strategies to harness their potential for reliable income

Starting With Credit Spreads

First off, you’ll need to understand what a credit spread is before you can start generating income from it.

When starting with credit spreads, you’re essentially selling one option and buying another, both at different strike prices but in the same expiration cycle. With this method, you can generate an income from credit spreads, provided you’re strategic and aware of the associated risks.

The maximum profit you can gain is the net premium received, while your potential loss is the difference between the strike prices, less the premium received. It’s all about balancing risk and reward. Understanding the mechanics of credit spreads is key to taking advantage of their income-generating potential.

Understanding the Pros and Cons

Understanding the pros and cons of credit spreads is just as important as knowing how they work, as this can impact your income generation potential.

Limited Risk: Credit spreads limit your potential losses. This is a big benefit when you’re trying to generate an income from credit spreads. The maximum loss in a credit spread is typically limited to the difference between the strike prices of the options minus the net premium received when entering the trade. This maximum loss is realized if the underlying asset’s price moves against the position, causing both options to expire in the money.

Income Generation: Credit spreads can provide a steady income stream. This can be a game-changer, providing regular income regardless of market fluctuations.

Flexibility: Credit spreads offer a range of strike prices and expiration dates. This gives you the power to set up the trades according to your specific needs and risk tolerance.

Limited Profit Potential: While credit spreads offer a more controlled risk profile, the flip side is that they also have limited profit potential. The maximum profit is capped at the net premium received when entering the trade. This limitation may not satisfy traders seeking substantial gains in a short time frame.

Margin Requirements: Trading credit spreads often requires tying up a significant amount of capital as margin collateral. This can limit your ability to allocate funds to other trading opportunities or investments. High margin requirements can be a drawback for traders with limited capital or those looking for more diversified strategies.

Different Types of Credit Spreads For Income

When you’re looking into credit spreads, you’ll find two main types: bull put spreads and bear call spreads. These are different types of credit spreads that can generate an income.

| Bull Put Spreads | Bear Call Spreads | |

|---|---|---|

| 1 | Used in a bullish market | Used in a bearish market |

| 2 | Sell put option, buy put option at lower strike price | Sell call option, buy call option at higher strike price |

| 3 | Income generated from premiums | Income generated from premiums |

| 4 | Risk is limited to difference between strike prices minus the premium | Risk is limited to difference between strike prices minus the premium |

| 5 | Profit when stock price rises | Profit when stock price falls |

Understanding these options and using them can increase your income either as a second income stream or primary source.

Ultimate Goal of Trading

Your ultimate goal in trading credit spreads should be to consistently generate income while managing and minimizing risk.

Here are three primary steps to help you reach the ultimate goal of trading:

- Knowledge is Power: Understand the mechanics of credit spreads and how market conditions can affect them. This knowledge will equip you to make informed decisions and generate an income from credit spreads.

- Risk Management: Develop a sound risk management strategy. You can’t control the market, but you can control how you respond to its fluctuations.

- Consistency is Key: Regularly review and adjust your strategies based on market performance. Consistency in managing your trades can lead to more stable returns.

By following these three fundamental steps, you can work toward realizing your ultimate trading ambition: steady income generation with controlled risk.

Put Credit Spread Example

Scenario: Suppose you are bullish on a stock, let’s call it “ABC Inc.,” which is currently trading at $70 per share. You believe that the stock will either go up or remain relatively stable in the near future.

Scenario: Suppose you are bullish on a stock, let’s call it “ABC Inc.,” which is currently trading at $70 per share. You believe that the stock will either go up or remain relatively stable in the near future.

Trade Details:

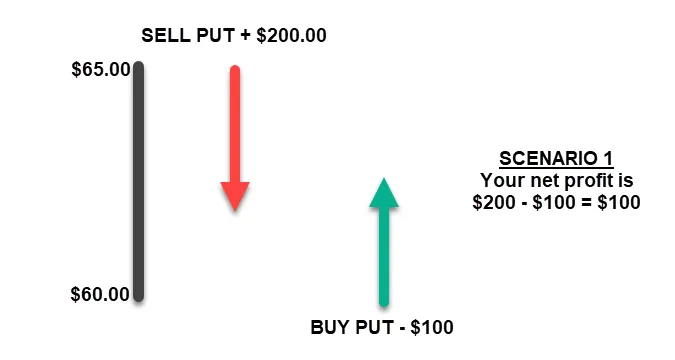

- Step 1 – Sell a Put Option: You sell a put option with a strike price of $65 and receive a premium of $200 (the credit) for selling this option. By selling the put option, you are essentially agreeing to buy 100 shares of ABC Inc. at $65 per share if the option holder decides to exercise the option.

- Step 2 – Buy a Put Option (Protection): To limit your potential losses, you buy a put option with a lower strike price of $60 and pay a premium of $100 for this protection. This put option allows you to sell 100 shares of ABC Inc. at $60 per share if the stock’s price falls significantly.

Outcome Scenarios: Now, let’s consider different scenarios at option expiration:

Scenario 1: The stock price rises or remains above $65

- In this case, both put options expire worthless.

- You keep the $200 premium from selling the $65 strike put option.

- You also lose the $100 premium paid for the $60 strike put option.

- Your net profit is $200 – $100 = $100.

Scenario 2: The stock price falls but stays above $65

- The $65 strike put option expires worthless.

- You lose the $100 premium paid for the $60 strike put option.

- Your net loss is $100.

Scenario 3: The stock price closes at $65

- The $65 strike put option is exercised, and you are obligated to buy 100 shares of ABC Inc. at $65 each.

- You also lose the $100 premium paid for the $60 strike put option.

- Your net loss is $100 + ($65 – $60) x 100 = $600.

Scenario 4: The stock price falls below $65 but stays above $60

- The $65 strike put option is exercised, and you buy 100 shares of ABC Inc. at $65 each.

- The $60 strike put option expires worthless.

- Your net loss is ($65 – $60) x 100 = $500.

Scenario 5: The stock price falls below $60

- Both put options are exercised.

- You buy 100 shares at $65 (as per the $65 strike put option) and immediately sell them at $60 (as per the $60 strike put option).

- Your net loss is ($65 – $60) x 100 = $500.

In this example, a put credit spread allows you to generate income (the $100 premium) while limiting your potential losses. It’s a strategy employed when you have a moderately bullish or neutral outlook on a stock.

Similar Income Generating Strategies

In addition to credit spreads, there are other effective strategies you can use to generate income. It’s key to diversify your approach to income generation, especially in uncertain market scenarios. Let’s look at three similar income generating strategies:

| Strategy | Description | Risk Level |

|---|---|---|

| Covered Call | Sell a call option on securities you own | Moderate |

| Dividend Investing | Invest in companies that regularly pay dividends | Low |

| Peer-to-Peer Lending | Lend money to individuals or small businesses online | High |

These strategies, just like how you generate an income from credit spreads, require careful analysis and planning. Each comes with its own risk and reward profile, so it’s crucial to choose the one that aligns with your risk tolerance and investment objectives.

Benefits and Considerations of Credit Spreads

Wondering about the benefits and considerations of using credit spreads for income generation. Let’s delve into this income generating option.

- Limited Risk: Credit spreads limit your potential losses. This is an incredible benefit when you’re trying to generate an income from credit spreads.

- Income Generation: Credit spreads can provide a steady income stream. This can be a game-changer for many, providing regular income regardless of market fluctuations.

- Flexibility: Credit spreads offer a range of strike prices and expiration dates. This gives you the power to tailor your investment strategy to your specific needs and risk tolerance.

Always remember the considerations of credit spreads: they require a solid understanding of the market and diligent risk management.

Frequently Asked Questions

What Are Some Common Mistakes Beginners Make When Trading Credit Spreads?

When you’re starting out with credit spreads, you often make mistakes like not fully understanding the risks involved. You might also neglect to manage your trades effectively, which can lead to significant losses. It’s common to disregard the importance of liquidity and bid-ask spread, and to underestimate the impact of market volatility.

How Does Market Volatility Affect Credit Spread Income?

You’re selling high volatility, so when the market steadies, your spread decreases. On the flip side, if volatility rises, your spread may increase. It’s a balancing act, navigating market volatility. To maximize income, you need a strategic approach, analyzing trends and adjusting your positions.

Can I Make a Full-Time Income From Trading Credit Spreads?

Yes, you can make a full-time income from trading credit spreads. However, it’s not as simple as it sounds. You’ll need a solid understanding of options trading, a well-thought-out strategy, and the ability to manage risk effectively. It’s also important to stay informed about any changes to the state of the overall market.

How Much Initial Investment Is Typically Needed to Start Trading Credit Spreads?

As a rough guideline, traders often start with a few thousand dollars to comfortably trade with credit spreads, but it’s essential to check with your broker and consider your risk tolerance and position sizing to determine the initial investment needed for your trading strategy. Always ensure that you have enough capital to cover potential losses and meet margin requirements without overextending yourself.

Are There Any Specific Software or Tools Recommended for Tracking and Managing Credit Spreads?

To track and manage credit spreads effectively, traders can utilize various tools and software. Most online brokers offer options trading platforms with real-time data and order execution capabilities. Specialized options analysis software like Thinkorswim and Tastyworks provides advanced risk analysis and backtesting capabilities. Subscribing to financial news services helps traders stay informed about market events, while options chain tools visualize spread components. Spread trading software streamlines position tracking, and risk management calculators aid in assessing profit and loss scenarios. Additionally, maintaining a trade journal using dedicated apps can enhance overall strategy management.

Conclusion

With credit spreads, you’ve got a powerful tool to generate income. Understand its pros and cons, explore its diverse types, and master its strategies. Also, consider similar income-generating strategies. Remember, the ultimate goal isn’t just profit, but consistent, sustainable income.

Unlock the Secrets to Options Trading Success!

Discover the 6 game-changing secrets that have powered success for over 24 years. Dive into our exact trading blueprint, learn how to capitalize on volatile markets, and find out how to achieve returns of up to 120% on top-performing stocks like Amazon, Netflix, and Bank of America.