- September 28, 2022

- Posted by: CoachShane

- Categories: Options Trading, Trading Article

Moneyness is a term used to describe the value of an option at a point in time during the life of the contract. An option’s moneyness can be either in-the-money, at-the-money, or out-of-the-money and this is used to describe the “intrinsic value” of the options contract.

The moneyness of an option affects the option’s price, which is why it’s important to understand when trading options. The amount of moneyness that’s present in an options contract can fluctuate throughout the contract and is dependent on the underlying price and the strike price of your contract.

When we are discussing basic calls and puts, it is fairly simple to understand. Once a trader uses more complex Option strategies, things get a little more detailed.

However, there are some key points to remember when trading options.

When you trade options, you’re not actually buying or selling anything. You’re betting on whether or not something specific will happen to the underlying asset.

Options contracts have a specific expiration date. Once that date has passed, the contract is worthless.

In short, if you buy a call option contract, you’re making a bet that the price of the underlying asset will go up and exceed a certain amount before the contract expires. If the price goes down, then you can lose part or all of the premium you paid

If you sell an option contract, you’re making a bet that the underlying asset will drop by the specified amount before expiry.

How To Determine The Value of An Option

When options trading, it’s important to be able to determine the value of an option. The value of an option is based on two components: intrinsic value and extrinsic value. Let’s take a closer look at each of these two components.

Intrinsic Value

The intrinsic value of an option is the amount by which the option is in or out of the money if it expired today. It is determined by comparing the underlying security price with the strike price of the option.

If there is intrinsic value in a contract, it means the contract is in the money as the underlying is above the strike price for a call option.

No intrinsic value means the contract is out of the money.

An options trader should always know the state of their options contract. You can easily determine if there is an intrinsic value by asking yourself, if it expired right now, is there value?

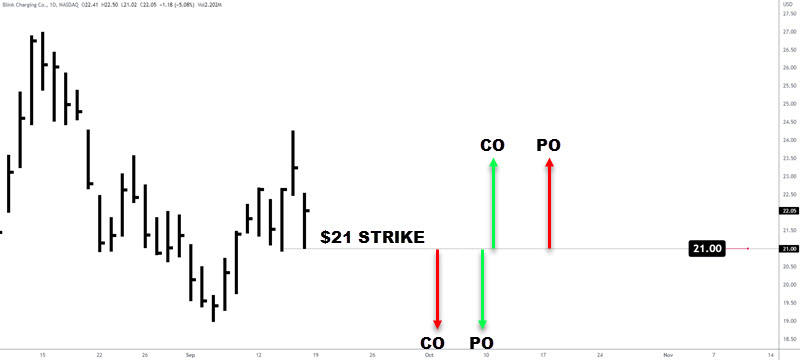

In this example, a call option with a $21 strike price would have intrinsic value and a put option, would not. On the downside for a put option, if price is below the strike price, it has value and the call option would not.

Extrinsic Value

Extrinsic Value

This is a little more complicated and the major focus is on how much time is left in the contract. Once you put on an options trade, the clock is ticking and depending on your strategy, you need movement in the underlying quite quickly.

A simple comparison is a contract with 30 days expiration and 90 day expiration. The 90 day has more extrinsic value because it has more time for the underlying to move. You will pay a higher premium for these options because, as the saying goes, time is money.

Less time remaining, think “lotto plays” where people deal with 1 day expirations, these have no extrinsic value and are generally very cheap.

In The Money Option

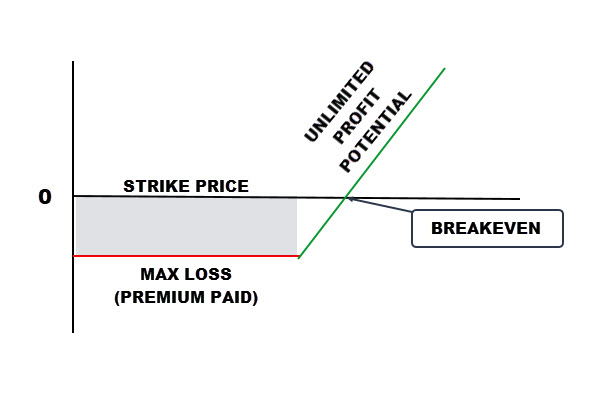

An in-the-money (ITM) call option is an option with a strike price that is lower than the underlying asset’s current market price.

Intrinsic value is determined by taking the difference between the strike price and the underlying asset’s current market price.

For example, if you own a call option on XYZ stock with a strike price of $50 and XYZ stock is currently trading at $60, your option is in-the-money. That’s because you have the right to buy XYZ stock at $50, even though it’s currently trading at $60.

This contract currently has value and if you were to close your position right now, you would make a profit. The higher the underlying price goes, the more value your contract has.

In our example, the intrinsic value of the ITM call option would be $10 ($60 – $50).

Looking at the breakeven point, this is the strike price plus the cost of the option that needs to be exceeded. If the option cost $2.00 per share with a strike price of $21, you need the underlying to beat $23.00 to find yourself in profit. In the below example, while price is above the strike price and “in the money”, it is below break even.

ITM options are more expensive than other types of options because they have intrinsic value— meaning they would be worth exercising even if there was no time value (extrinsic value) left on the option.

The closer an option is to being in-the-money, the more expensive it will be because there is a greater chance that it will expire with value. The further an option is from being in-the-money, the less expensive it will be because there is a lower chance that it will expire with value.

Out-of-the money options

Out-of-the money options are contracts with strike prices that are outside of the underlying asset’s current price range. For call options, this means a strike price above the current price. For put options, it means a strike price below the current price.

In this example, we are using a $24.00 strike price for a call option and the current price is $21.00. This option contract would be out of the money as the current price is below the strike price. Out-of-the money options usually have a lower premium than in-the-money options because they are less likely to be exercised.

How Out of the Money Options Work

When you buy an out-of-the-money option, you are essentially betting that the underlying asset will move enough in price to make your option profitable.

For instance, let’s say you buy a call option on XYZ stock with a strike price of $50 when the stock is currently trading at $45. For you to make money on this trade, XYZ stock would need to go up to at least $50 per share (+ premium) when your option expires. If it doesn’t, then your option will expire worthless and you will lose your premium.

The premium you pay for OTM is not as high at ITM options as they have no intrinsic value (but could have extrinsic). In addition, OTM options tend to have a longer life span than ITM options. This is because OTM options are less likely to be traded or exercised before their expiration date.

At-the-Money Options

At the money (ATM) is a term used to describe an options contract with a strike price that is identical (close to) to the underlying market price. ATM options are interesting because they are at the point where they can become profitable.

Because they are right on the edge of being in or out of the money, they see a lot of trading activity around those prices. These options have no intrinsic value and the traders will take a loss if they chose to exercise the contract because they have paid a premium when purchasing it.

Key points to keep in mind:

There is a probability that the option will become in the money because it is already bordering on having an ITM type of moneyness.

At-the-money options are more sensitive to changes in underlying asset prices than other options. A few cents either way can make it ITM or OTM.

Which One Is Better To Use?

In-the-money options contracts are contracts that have positive intrinsic value and are expensive compared to others.

Out-of-the-money options contracts have no intrinsic value because the contract’s strike price is, for a call, higher than the current underlying price.

Which one is better for you? It depends on your trading goals. As long as you understand what each option type does, you should be able to decide which one makes sense for your situation.

At Netpicks, our basic buying call strategy uses ITM options because of the value that is present. OTM options do have uses and are often used in various strategies including covered calls and puts.

You can learn more about how Netpicks approaches Options Trading by downloading Our Secret Options Strategy That Squeezes Profits Out Of Volatile Markets