- July 8, 2024

- Posted by: Shane Daly

- Categories: Day Trading, Trading Article

To set up a personal trading room, begin by selecting a quiet, distraction-free area with natural or soft artificial light to lessen eye strain. Outfit the space with a high-performance computer, multiple monitors for improved data visualization, and reliable software for market analysis.

A high-speed internet connection and a backup power source like a UPS are important for uninterrupted trading. Integrate ergonomic furniture, such as an adjustable chair and a desk at an appropriate height.

Maintain a comfortable temperature, and consider noise-cancelling headphones to sustain concentration. By organizing these components effectively, you’ll create a great environment for making trading decisions calmly and efficiently.

Main Points

- Equip the room with multiple monitors and a reliable computer for efficient data analysis.

- Look for ergonomic furniture, including an adjustable chair and wrist supports to prevent strain.

- Use natural or daylight-mimicking artificial lighting to minimize eye fatigue.

- Establish a clutter-free environment with a clear separation of trading and personal spaces.

- Ensure a high-speed internet connection and backup power source to maintain consistent trading activities.

Selecting the Ideal Workspace

Choosing the right location for your trading room is important, as it should be a calm, dedicated space free from distractions to enhance your focus and efficiency. When selecting your workspace, consider both lighting preferences and noise levels, which are vital to sustaining concentration and minimizing fatigue.

Natural light is ideal, but if not available, ensure your room is equipped with sufficient artificial lighting that mimics daylight to keep you alert and reduce eye strain.

The layout and design aesthetics of your workspace also play a significant role in enhancing productivity. An ideal workspace layout should allow for a clear separation between trading and personal areas to strengthen a professional mindset.

Incorporate clean, streamlined design elements to avoid visual clutter that could divert your attention from trading tasks.

Choose colors and decorations that are not overly stimulating, as a more neutral palette helps sustain focus.

Consider the acoustic properties of your room. Soft furnishings can help absorb sound, making the space quieter. If external noise is unavoidable, think about using noise-canceling headphones as part of your trading setup to further isolate and immerse yourself in your trading environment.

Many studies are showing how the area you work in can affect your productivity so ensure you put time and effort into setting up the best space you can.

Essential Trading Equipment

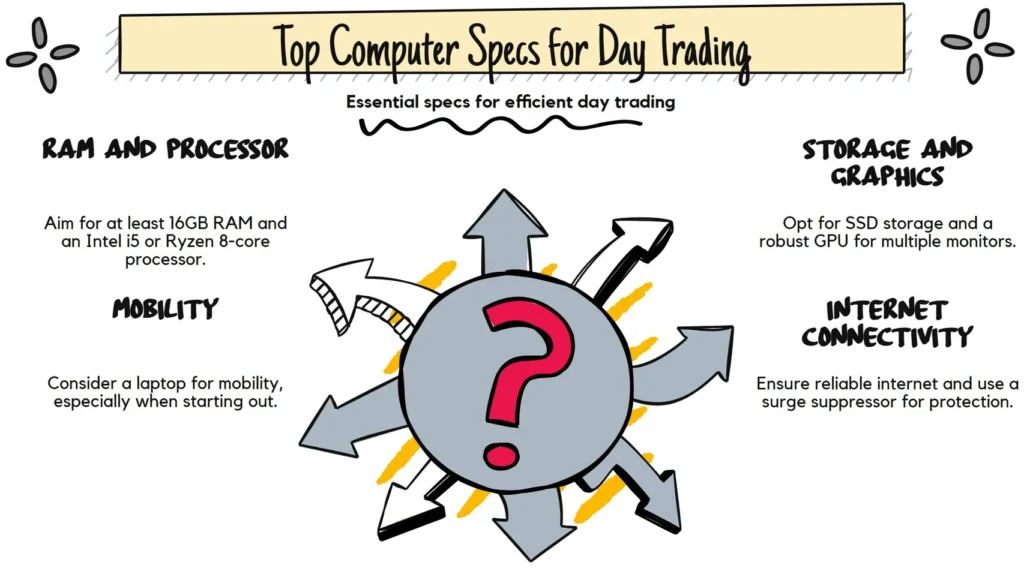

Having established a prime workspace, the next step is to equip it with the necessary trading tools to guarantee efficiency and effectiveness in your activities. Number one among these necessary trading tools is a reliable computer, which is the backbone of your operations.

A computer with robust processing power ensures you can execute trades without an issue and run sophisticated trading software without any problems.

This software is essential for accessing real-time market data, utilizing advanced charting tools, and managing order execution, all vital for successful trading.

Customizing workstations with multiple monitors significantly boosts your ability to multitask, analyze complex data, and keep an eye on various instrument trends simultaneously.

Ensuring your connectivity is top-of-the-line is important. A high-speed internet connection minimizes the risk of delays in data transmission, which is essential in the fast-paced world of trading.

Equipping your trading station with a backup power source, such as an Uninterruptible Power Supply (UPS), safeguards your trading activities during power outages, ensuring you are always operational and your data is protected.

Optimizing Trading Conditions

To improve trading conditions, maintaining a comfortable room temperature between 68-72 degrees Fahrenheit is important for boosting focus and productivity. Additionally, effective temperature control can be paired with appropriate lighting options.

Using natural light or installing adjustable lamps can significantly reduce eye strain and create an ambient environment conducive to prolonged trading sessions.

Noise reduction is vital in a trading room setup. Investing in noise-cancelling headphones can help minimize external distractions, allowing for deeper concentration and more effective decision-making. These headphones are beneficial in busy or noisy home environments, where maintaining focus can be challenging.

A clutter-free desk promotes an organized mind, important for quick and efficient trading. Keep your trading area tidy with minimal items on your desk, and consider designated spots for all your trading tools and resources.

Ergonomic Trading Considerations

Ergonomic considerations are necessary for maintaining health and enhancing efficiency in a personal trading room setup. One of the primary ergonomic chair options includes choosing models that offer adjustable lumbar support, armrests, and seat height to guarantee alignment and support of the spine during long hours of trading.

Additionally, integrating wrist support such as padded mats or ergonomic keyboards can significantly reduce the risk of strain on your wrists, promoting longevity in trading activities.

Proper monitor placement is important; the top of the monitor should be at or slightly below eye level and about an arm’s length away, which helps minimize eye strain and maintain a comfortable viewing angle.

Lighting solutions also play an important role in an ergonomic trading environment. Ensure that the room is evenly lit, using layers of lighting to avoid shadows and glare that could cause eye fatigue. Utilizing task lighting can also help in focusing on specific documents or screens without straining your eyes.

Developing a Trading Routine

Establishing a consistent trading schedule is important for developing discipline and routine in your trading activities. By integrating daily routines and trading habits into your strategy, you create a framework that supports effective decision-making. Begin by setting specific goals and targets for each session, which helps maintain focus and motivation.

At Netpicks, we use “POQ” or “Power of Quitting” to set our goals and targets for the day. Reach out to our support team for more information on this ground breaking approach.

This methodical approach allows you to measure progress and adjust strategies as needed.

Mental preparation and focus training are big components of a successful trading routine. Before the market opens, spend time preparing mentally, reviewing your plan, and setting your mindset. This can include meditation, reviewing past trades, or visualizing successful trades.

Such practices boost your psychological readiness and help manage emotions, preventing impulsive decisions based on market fluctuations.

Regularly reviewing and analyzing your trades is also important. This not only helps in recognizing your strengths and weaknesses but also in fine-tuning your trading strategies. Make it a habit to assess the effectiveness of your decisions and learn from both successes and failures.

Staying informed about market news and trends is an important part of being a trader. It ensures that your trading decisions are educated and aligned with current market conditions.

Frequently Asked Questions

How Do I Secure My Trading Setup Against Cyber Threats?

To secure a trading setup against cyber threats, implement firewall protection, use a VPN to encrypt internet connections, update antivirus software regularly, enable two-factor authentication, and be cautious with downloads and links.

What Are Affordable Alternatives for Trading Software?

Affordable alternatives for trading software include free platforms like Robinhood and Webull. DIY solutions such as using open-source software like MetaTrader 4 can also reduce costs while providing customization options for traders.

Can Natural Lighting Affect My Screen Visibility and Trading?

Natural lighting can significantly impact screen visibility due to glare, potentially hindering productivity. Employing curtains and anti-glare protectors are effective strategies to mitigate this and improve screen clarity and trading efficiency.

How to Manage Stress During Trading Downtimes?

To manage stress during trading downtimes, incorporate meditation breaks and relaxation techniques. Regular exercise routines also serve as effective stress relief strategies, enhancing focus and emotional resilience in challenging market conditions.

What Are the Best Snacks for Maintaining Energy While Trading?

For maintaining energy while trading, opt for healthy snacks like nuts, seeds, and energy bars. Fresh fruits and whole grains are ideal. Prioritize hydration by increasing water intake, essential for sustained cognitive function.

Summary

Establishing a personal trading room requires careful planning and consideration of various factors. Selecting an appropriate workspace, equipping it with essential tools, and optimizing trading conditions are critical steps.

Ergonomic considerations guarantee comfort and sustainability, while a structured trading routine aids in maintaining discipline and consistency. By addressing these issues, you can create an environment conducive to effective and efficient trading, ultimately supporting better decision-making and potentially improving your trading performance.