- July 27, 2022

- Posted by: CoachShane

- Category: Trading Article

One of the most important things you can do as a trader is to protect your trading capital. This means setting protective stop losses on every trade you make. A protective stop loss is simply a predetermined point at which you will sell a security to limit your losses if the price moves against you.

A variation of the standard stop loss is the trailing stop which is used to lock in profits as price goes in your direction.

In this blog post, we will discuss how to set your protective stop losses and why they are so important.

What is A Protective Stop Loss?

A protective stop loss is an order to sell a security when it reaches a certain price point. This is typically used to limit how much you will lose on a trade or investment.

For example, if you buy a stock for $100 and place a protective stop loss at $95, then your broker will sell the stock if it falls to that level. In that case, you will lose $5.00.

Protective stop losses can also be used to lock in profits on a trade known as a trailing stop. For example, if you buy a stock for $100 and it increases in price to $120, you raise your initial protective stop loss to $115. This would sell the stock if it fell back to that level, but would still allow you to profit if the stock continued to rise.

It is very simple to set your stop and there is no reason that a trader should be trading without one. While some traders will use a mental stop, the bottom line is they do have a price point where they will get out.

Why Is A Protective Stop Loss Important?

Nothing is certain in trading and a protective stop loss is an essential tool for managing risk.

Again, a stop loss is a pending order to sell a security when it reaches a certain price, and it can help to prevent significant losses in the event of a price drop.

One look at this losing streak chart shows the probabilities of you taking a loss.

If you fail to manage risk and let your losing trades become too large, could you recover? Let’s take a look at the gains needed during certain drawdown levels.

Imagine your trading strategy produces a 60% win rate and you were 100% guaranteed to take four losing trades in a row in the future. Also, consider that each loss is a 15% drawdown in your capital.

The chances of you coming back to trade another day is very slim and your trading career would be over.

How To Set Your Protective Stop Loss

If you’ve accepted the obvious risks in trading, you accept you need a protective stop. No matter how much research you do or how confident you are in a trade, there is always the potential for losses. That’s why it’s important to have a plan in place for how to deal with those losses.

Your stop is that plan but how do you determine where to set your stop loss? There are a few factors to consider.

First, you need to look at the overall trend of the market. If it’s been on a steady decline but still holding an overall uptrend and you are looking to get long, you may want to set your stop loss lower than you would if the market was strongly in your direction.

You also need to think about your own risk tolerance and ability to see the market go against you. If you’re more risk-averse, you’ll likely want to set your stop loss closer to the current market price. Tighter stops to your entry price does have benefits for position sizing but it also at risk of multiple stop outs.

And finally, you need to consider the specifics of the security you’re trading. If it’s a volatile instrument, you may want to set your stop loss further away from the current price to give it some room to fluctuate.

Using The ATR To Place Determine Your Stop Loss Price

The ATR indicator can be a helpful tool when setting a stop loss order. The ATR measures the volatility of an instrument, and can help you gauge how far away from the current price you should set your stop loss.

For example, if the ATR is showing that a security is very volatile at this point in time, you may want to set your stop loss further away from the current price to give it some room to fluctuate.

In this chart, you can see on the left that the average true range indicator was showing a fairly steady reading. From the middle to the right, a rapid increase in the ATR (+$6) is showing that the instrument has increased in volatility. You may want to give your stop some breathing room. You can see on the right side that the candles have a larger range than the ones on the left side. Using the same stop distance will result in faster losses.

Also note that a rise the ATR could also be pointing to an exhaustion in the instrument so be ready for a potential reversal.

Conversely, if the ATR is showing that a security is not very volatile, you may want to set your stop loss closer to the current price.

Here is just one of the popular strategies to use when setting your stop loss with the ATR.

Price had pulled into a previous area of resistance and now potential support. We have a hammer reversal candle and for this example, assume you buy stop the high at $23.05.

Our ATR reading at that time was $1.59. If you were using a 1X ATR, the calculation would be 23.05 (entry price) – 1.59 (1X ATR) and your stop would be at the support level (see the faint red line).

1X ATR actually puts you in the noise of the instrument so I’d consider 1.5 or 2X the ATR. You can see the 2X ATR is far from your entry price and can be adjusted once price moves in your direction.

The ATR is just one tool that can be used when setting a stop loss order, and it’s important to consider all of the factors mentioned earlier when making your decision.

Using Swing High/Low Zones For Protective Stops

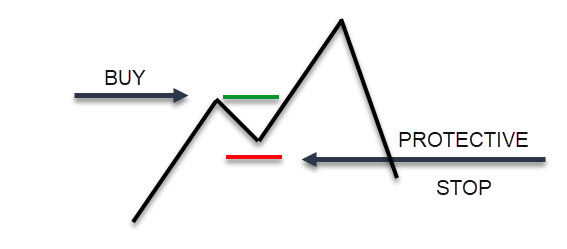

Another method that can be used to place a stop loss is by using swing highs and swing lows. This method involves placing your stop loss at a level below the most recent swing low or above the most recent swing high.

For example, if you’re looking at a chart and see that the most recent swing low was $100, you would place your stop loss at a level below that, such as $95.

How far under the swing low would you place it? In trading, we’d like to keep things as objective as possible so we can combine the ATR reading with the stop level.

In this example, price retraced to a former support level and put in a bullish engulfing candlestick.

A trader enters a buy stop order above the bullish engulfing candle and sets their stop loss at the low of the candle minus 20% : 35.95 – (.20 x .83 ATR) = $35.78 which is your stop loss trigger price. You can use any percentage of the ATR but remember you are subtracting it from the low of the candle. Too far away equals smaller position sizing. 20-50% of the ATR is a good starting point.

Again, it’s important to consider all of the factors mentioned above when making your decision.

Conclusion

Protective stop losses are one of the most important tools traders have to protect their trading capital. By setting your protective stop losses correctly, you can limit your losses on any given trade and preserve your profits.

We have discussed two different ways to set your protective stop losses – using the ATR and Swing High/Low Zones. Whichever method you choose, make sure you use it every time you enter a trade.

Protecting your trading capital is essential for long-term success as a trader. Are you protecting your trading account with stop losses?