- September 28, 2023

- Posted by: CoachShane

- Categories: Advanced Trading Strategies, Trading Article

The power of a rules-based trading strategy is evident through various things: encompassing discipline, consistency, adaptability, risk management, continuous improvement, and the potential for automation. By providing a clear framework for decision-making, it helps traders tackle the market with confidence and can help contain emotional trading mistakes.

No strategy is foolproof, and a rules-based approach must be combined with sound judgment, ongoing education, and proper risk management to achieve long-term success in trading.

Here’s a look at the key strengths of a rules-based trading strategy:

1. Discipline and Consistency:

- Discipline: By adhering to a set of predefined rules, traders can avoid impulsive decisions driven by emotions like greed or fear.

- Consistency: Applying the same rules across different trades ensures a uniform approach, reducing inconsistencies that can arise from subjective decisions.

2. Reduction of Human Error:

- Eliminates Guesswork: A rules-based strategy provides clear guidelines for entry, exit, stop-loss, and take-profit levels, reducing ambiguity and guesswork.

- Minimizes Emotional Bias: By sticking to the rules, traders can minimize emotional biases that often lead to poor decision-making.

3. Adaptability and Flexibility:

- Tailoring to Different Markets: Rules can be adjusted or customized to suit different markets or trading styles, allowing for a more versatile approach.

- Responsive to Market Changes: Regular review and adjustment of rules enable traders to adapt to changing market conditions, keeping the strategy relevant.

4. Risk Management:

- Defined Risk Parameters: By setting clear rules for risk management, such as position sizing and stop-loss levels, traders can better control potential losses.

- Protection Against Major Losses: A well-defined strategy helps in avoiding catastrophic losses by adhering to risk management principles.

5. Performance Analysis and Improvement:

- Measurable Results: A rules-based approach allows for easier tracking and analysis of performance, identifying areas for improvement.

- Continuous Learning: Regular review and refinement of the rules lead to continuous learning and improvement, enhancing the trader’s skills over time.

6. Potential for Automation:

- Algorithmic Trading: Rules-based strategies can be coded into algorithms, allowing for automated trading, which can execute trades more efficiently and without human intervention.

Understanding the Edge of a Rules-Based Approach

Adopting a rules-based approach in your trading is essential to gain a competitive edge in the market and increase your chances of becoming a profitable trader.

By adhering to a rules-based strategy, you can maintain focus, avoid emotional decision-making, and prevent costly mistakes that often stem from impulsive actions.

A set of well-defined rules in your trading strategy serves multiple purposes. First, it eliminates guesswork and emotions, which are often the root causes of confusion and poor judgment in trading. By having a clear path to follow, you can make better decisions.

Compare Strategy Across Sectors

A rules-based approach allows for a systematic comparison of performance across different sectors. Analyzing how a particular strategy performs in various market conditions can provide valuable insights into that strategy. It enables you to identify which markets are more compatible with your strategy and which ones may require fine-tuning or even a complete overhaul.

This ensures that your trading approach remains robust and relevant, even as markets change.

A rules-based strategy encourages continuous learning and improvement of your strategy and trading skills. By regularly reviewing and adjusting your rules in response to the results you are getting, you can refine your trading skills.

Role of Technical Analysis in a Rules-Based Strategy

Use technical analysis as a key tool in your rules-based approach to increase the effectiveness of your trading decisions.

Technical analysis plays a role in a rules-based strategy, but it is important to understand its limitations. While technical analysis provides insights into price patterns and trends, it is not foolproof and traders should know that while it can tip the odds in your direction, it is not perfect.

To enhance the accuracy and reliability of your trading decisions, it can be good to combine fundamental analysis with technical analysis. Fundamental analysis helps you understand the underlying factors driving market movements and provides a broader understanding of the price action you are seeing.

How a Rules-Based Strategy Reduces Guesswork

Following a rules-based strategy eliminates the need for subjective decision-making, as it provides a clear set of criteria for trading decisions. This clarity reduces confusion and eliminates the guesswork that often plagues traders.

The psychology behind following a rules-based strategy is all about discipline and the belief that consistent adherence to a proven strategy will lead to long-term success. By removing emotions and personal biases from the process, traders can make objective decisions based on set rules.

It is essential to acknowledge the potential drawbacks of a rules-based approach in trading.

One potential drawback is that it may limit flexibility in adapting to changing market conditions. Markets are dynamic, and a strict adherence to rules may prevent traders from capitalizing on new opportunities or adjusting their approach when necessary.

Another drawback is the risk of over-optimization. Traders may be tempted to tweak their strategy excessively based on historical data, leading to a strategy that performs well in back testing but fails in real-time trading.

Testing and Optimizing a Rules-Based Trading System

By regularly testing and optimizing your rules-based trading system, you can increase the effectiveness and profitability of your strategy. Testing strategies allows you to evaluate the performance of your system and identify areas for improvement.

Through optimization (not over-optimization), you can fine-tune the parameters of your strategy to maximize its performance and adapt to changing market conditions.

To effectively test and optimize your rules-based trading system, you can use a combination of historical data analysis and forward testing. Historical data analysis involves back testing your strategy using past market data to assess its performance. This helps you identify potential weaknesses and refine your rules accordingly.

Forward testing involves implementing your strategy in real-time, using simulated or small position sizes, to gauge its performance in current market conditions. This allows you to validate the effectiveness of your system and make any necessary adjustments before committing larger amounts of capital.

Here is an example of a testing and optimization process:

| Step | Description |

|---|---|

| 1 | Define the objective and criteria for testing |

| 2 | Gather historical market data |

| 3 | Back test the strategy using the historical data |

| 4 | Analyze the results and identify areas for improvement |

| 5 | Adjust the parameters of the strategy |

| 6 | Forward test the optimized strategy |

| 7 | Monitor and evaluate the performance |

| 8 | Repeat the process periodically to adapt to changing market conditions |

Regular testing and optimization of your rules-based trading system is essential for maintaining its effectiveness and profitability. By continuously refining your strategy, you can increase your chances of success and achieve consistent profits in your trading endeavors.

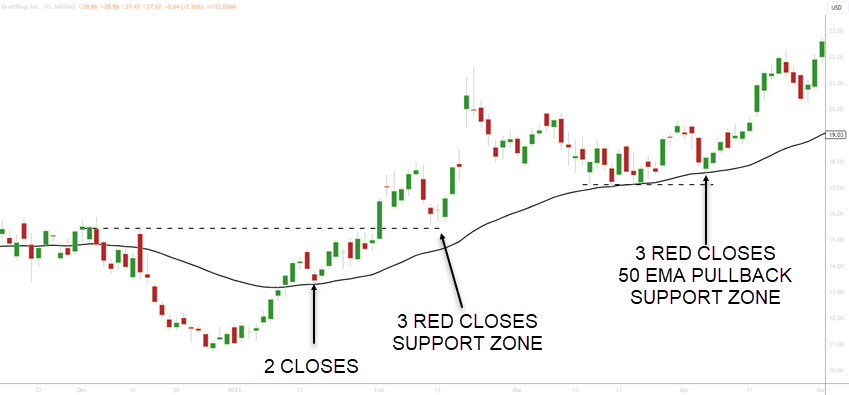

Rules-Based Trading Strategy Using Pullbacks to 50 EMA

This is a simple rules-based trading strategy that uses pullbacks to locate trade setups.

1. Identify the Trend Direction:

- Bullish Trend: Price breaks above the 50 EMA.

- Bearish Trend: Price breaks below the 50 EMA.

2. Wait for a Pullback:

- In a Bullish Trend: Wait for the price to pull back to the 50 EMA.

- In a Bearish Trend: Wait for the price to pull back to the 50 EMA.

- Pullback Length: All pullbacks must have 3 or more candlesticks closing lower/higher

3. Entry Rules:

- For a Long Position (Bullish Trend): Enter a long position when the price touches or comes close to the 50 EMA and shows signs of bouncing off it (e.g., a bullish candlestick pattern, new high).

- For a Short Position (Bearish Trend): Enter a short position when the price touches or comes close to the 50 EMA and shows signs of rejection (e.g., a bearish candlestick pattern, new low).

4. Stop-Loss Rules:

- For a Long Position: Place a stop-loss slightly below the 50 EMA or the low of the pullback.

- For a Short Position: Place a stop-loss slightly above the 50 EMA or the high of the pullback.

5. Take-Profit Rules:

- For a Long Position: Consider taking profits at a significant resistance level or a predetermined risk-reward ratio.

- For a Short Position: Consider taking profits at a significant support level or a predetermined risk-reward ratio.

6. Risk Management:

- Determine the position size based on a fixed percentage of your trading capital to ensure proper risk management.

- Common percentages are .5% – 2%

7. Review and Adjust:

- Regularly review the performance of this strategy and make necessary adjustments based on changing market conditions.

This rules-based strategy using pullbacks to a 50 EMA can be a powerful tool for traders looking to capitalize on trend continuations. It’s essential to back test the strategy on historical data and practice it in a demo account before applying it to a live trading environment.

Combining this strategy with other technical indicators or support and resistance zones can provide better trading signals. No strategy guarantees success, and proper risk management is vital to long-term trading success.

Combining this strategy with other technical indicators or support and resistance zones can provide better trading signals. No strategy guarantees success, and proper risk management is vital to long-term trading success.

Future of Rules-Based Trading: Automation

Implementing a rules-based trading strategy can come with its challenges. One of the main challenges is the discipline required to consistently follow the rules and not deviate based on emotions or market noise. Another challenge is the need for continuous monitoring and adjustment of the strategy to adapt to changing market conditions.

Automation has emerged as a powerful tool in enhancing rules-based trading strategies. Automation allows for the execution of trades based on pre-defined rules, eliminating the potential for human error and emotional decision-making.

Incorporating automation into rules-based trading strategies can provide traders with a significant edge in the market, increasing efficiency, accuracy, and overall profitability.

Frequently Asked Questions

Is rule-based trading profitable?

Rule-based trading can be profitable if done correctly. By following a set of predefined rules, traders can take advantage of market opportunities and make better decisions. These rules help eliminate emotions and impulsive actions, leading to more disciplined trading. With proper risk management and continuous refinement of strategies, rule-based trading can yield consistent profits over time.

How do you create a winning rule-based trading plan?

It is essential to define clear objectives and goals. Traders must identify their risk tolerance and establish risk management rules to protect their capital. Develop specific entry and exit criteria based on technical indicators, price patterns, or fundamental analysis. Back testing and paper trading can help validate the effectiveness of the plan before implementing it in real trading.

What is the most profitable trading strategy?

The most profitable trading strategy depends on various factors, including market conditions, trader’s skills, and risk appetite. Some popular strategies include trend following, breakout trading, and mean reversion. There is no one-size-fits-all approach. Traders need to identify a strategy that aligns with their strengths and suits the current market environment.

Why are trading rules important?

They provide a structured approach to decision-making, reducing the impact of emotions and impulsive actions. By following rules, traders can avoid making irrational choices driven by fear or greed. Trading rules help maintain discipline and consistency in trading. They prevent traders from deviating from their strategies and making impulsive decisions based on short-term market movement. Trading rules provide a framework for risk management, helping traders protect their capital and minimize losses.

What is the 1% rule in trading?

The 1% rule in trading advises traders to risk only 1% of their trading capital on any single trade. This rule helps manage risk by limiting potential losses. By adhering to this rule, traders can protect their capital and avoid substantial drawdowns.

What is the simplest most profitable trading strategy?

The simplest and most profitable trading strategy is a subjective matter and varies from trader to trader. However, a popular and straightforward strategy is trend following. This strategy involves identifying and trading in the direction of a prevailing market trend. Traders can use various technical indicators, such as moving averages or trendlines, to determine the trend’s direction and potential entry and exit points. By riding the trend, traders can capture significant profit potential.

What is the “3 trading rule”?

The 3 trading rule is a simple guideline that suggests traders should only enter a trade if they have identified three reasons to support their decision. These reasons can include technical indicators, fundamental analysis, or market sentiment. By having multiple confirming factors, traders can increase the probability of a successful trade. However, it is crucial to remember that the 3 trading rule should not be seen as a guarantee of success and that risk management should always be a priority.

Conclusion

A rules-based trading strategy offers a clear set of criteria for making informed trading decisions and reduces guesswork. By using the 50 EMA on your chart and identifying where the price breaks above and stays above it, you have a systematic approach that eliminates emotional biases.

Following a rules-based strategy provides consistency and control over your trading journey, increasing your chances of becoming a professional trader. Combining technical and fundamental analysis enhances the effectiveness of the strategy. Regular testing and optimization are essential for maintaining profitability and adapting to market conditions.