- February 10, 2022

- Posted by: CoachShane

- Category: Trading Article

What is the best moving average for swing trading? My favorite moving average as a swing trader and one that I have used for years, is the 20 period exponential moving average.

Moving averages are the most popular technical indicator for swing traders and they are great if you know how to use them. My trading style uses the moving average as supporting information. Price action is my main focus through the use of common chart patterns.

Is The EMA or SMA Best for A Swing Trader?

Traders can debate this topic for years and it’s a waste of time. In reality, it doesn’t matter what you use. The difference between the two is how they react to changes in price. Just like the name implies, each one of the averages will average out X periods of price, usually the closing price.

Simple Moving Average:

This is just an average calculation of the previous X periods that you set for the moving average

Exponential Moving Average:

Still an average calculation but the more recent price data is given more significance and is more sensitive to current price movements. This means it is not as affected to price shocks that occurred in the recent past.

If you want the average to react faster to changes in price, use the EMA version of the averages. SMA version will react slower to changes as well as not be as affected by large price shocks.

If you want the average to react faster to changes in price, use the EMA version of the averages. SMA version will react slower to changes as well as not be as affected by large price shocks.

There are also different types of moving averages with a completely different formula, such as the Hull moving average, to calculate the plot on the chart.

An important point is that the success of a swing trading strategy should not rely on which average you are using. If so, you may want to re-check your back testing and optimization methods.

What matters more, from an indicator standpoint, is the lookback period on the indicator you are using.

Is There A Best Period Setting?

This is where the decisions have to be made regardless of using a SMA or EMA. A lot will depend on the style of trading you use with your positions and what you are using the moving averages for.

As a lagging indicator, the higher the period setting, the more the MA will be behind current price. If, for example, you were using the moving averages for trend direction, the 10 EMA will confirm a change before the 50 EMA or the 100 EMA.

If you were a swing trader who prefers a mature trend to swing trade against, you’d look at the 50-100 EMA or even greater.

As for the 20 period moving average, this is a medium term indicator showing a shorter term trend. Although trend is part of my strategy, price action, momentum, and a standard chart pattern plays a larger part.

The best period for swing trading is going to depend on what you are using the indicator for. Unlike most tutorials, I won’t give you a blanket average to use for your swing trading because the best, is subjective.

Robust Strategy

How robust is your trading strategy if you must use a 21 period and not a 20? What if it has to use a 10 EMA and not a 12 EMA or it racks up the losses? What if it needs a 50 EMA but results fall apart with a 55?

It’s not robust and has been over optimized for the tested period. Over time, the strategy will be useless.

There is a “but” in there. There is a vast difference between a 10 period and 100 period setting. When talking robust, we are talking about settings in the area of the one you have tested.

Using Moving Averages For Swing Trading

There is nothing magical about moving averages. While many call them dynamic support and resistance, that isn’t really true although it can appear to be.

For every example where the moving averages “held” price, you can find examples where price blew through them without hesitation – as if there was nobody there to buy or sell. At those levels where price reacts, you will often find previous price levels where current price is rejecting from.

10 Period EMA

This was a favorite moving average for Marty Schwartz from the Market Wizards. For Marty, the 10 EMA had to be under price for an uptrend where he’d look for buys. When price moved under the average, sells were in order.

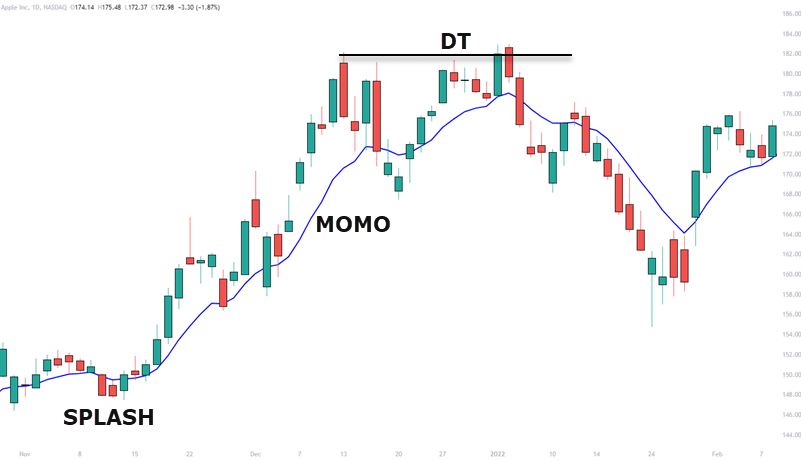

This stock chart of Apple shows the 10 EMA in action. In a strong trend, price will stay above the moving average. In those trades, swing traders will look for continuation trades to the upside. You can see where price “peels” away from the average where I used the label MOMO. When that occurs, price may be overbought and a reversal could be coming up as we see with the double top, DT.

As price ebbs and flows, you will see the stock price showing SPLASH. This is where price has broken the moving average but did not show a price structure change of trend. Far too many traders will trade these false signals. This is why it is vital that traders use price action and price structure along with an indicator.

This short term average is an objective way for a swing trader to measure momentum. It’s not perfect but can alert you to an increase in the volatility of the instrument. A strong trending instrument, which you do want to trade, will tend to stay above the 10 day average price. At the first sign of breaking down, a swing trader won’t have see too much of their profits eaten away if they use a break of the averages as a protective stop loss area.

Time Period Matters

I will use the 10 EMA as an example but it applies to any average you are using for trend. A trading indicator does not change the trend. Price does.

A moving average on a daily chart will interact with price differently on a 15 minute chart.

Market direction can be broken down into the following price movement:

+ Trend up is a series of higher highs and lows.

+ Down trend is lower highs and lows.

The daily chart will show an uptrend while the 15 minute chart with a 10 EMA, will show multiple trend changes. As you use a larger time period for the indicator such as the 20 or 50, price can be putting in a price action downtrend while the average shows an uptrend.

This is an example of why “best settings” don’t really exist. If you are searching for it, you are looking at things incorrectly. Optimizing for the best result will not necessarily carry through to next month, week, or even the next day.

20 EMA

A medium term average that takes into account about 4 weeks of price data. As a swing trader, I find this is a nice intermediate-term average that can be a good tool for momentum reads and an idea of trend (or lack of).

The 20 EMA gives price room to move and it suits my way of looking at price charts. At a top level look:

+ Price snakes around the average and I look at a trading range where we see a higher low. Plan for a break to the upside

+ Another trading range off a gap up. Price ranges long enough for the average to catch up giving the illusion of support

+ Price pulls away from the average showing me momentum. Not marked, but a consolidation at highs is bullish

+ Price pulls back into an area around the average price of the last 20 days. It’s also an area where price consolidated previously

The average was used to frame the market and not for confirmation of any trading decision.

50 EMA + 100 EMA

Both of these are longer term averages. You will hear that “institutions use them” but I’ve never seen any data to suggest that to be accurate.

What we see is the closing prices over these periods is increasing overall until we get to the end of this chart. Consecutive higher closing prices over a period of time, means uptrend.

There are many ways to trade this chart but it depends on your knowledge of simple price patterns. There are multiple pullbacks to around the moving average where traders can trade bull flags. These pullbacks pulled into areas where price was supported in the past. Those are trade entry locations that you can use.

Caution

I wrote that traders should not trade technical indicators blindly. If you were using the slope of the 50 EMA or a price crossover of the 100 EMA as trend, you may have thought a bearish trend was forming.

After this pushdown we see a long lower shadow showing price rejection. Price ranged for several day, unable to break lower. Strong momentum to the upside would have stopped out most short traders. Currently, there is is a consolidation at the highs of momentum which is generally bullish.

If I just traded moving averages, I’d be looking short while the higher probability is a long trade. Can price break down from the current range? Absolutely. But successful swing trading, like all trading, relies on probabilities.

Multiple Moving Average Crossover Strategies

When we get into the topic of moving average crossovers, including 3 or more moving averages, we go down a rabbit hole of finding the best settings for two averages. Again, no best setting but if we accept we will never catch the top or bottom of a move, we can find use in them for swing trades.

One often talked about strategy is the 9/30 trading strategy. There will those who say it doesn’t “work” (whatever that means), but at it’s core, it is a pullback trading method in the direction of a trend. The trend direction is shown by the increasing or decreasing price of both the long and short term averages. As a starting point, there is nothing wrong with it if you accept the limitations.

Conclusions

If you are looking for the best moving average for swing trading, there isn’t one. I know that is not a popular opinion because it takes the illusion of certainty away. Which type you use will depend on how you look to use it.

More important than a moving average, is how you manage risk and profit taking. Those are the most important aspects of trading. Don’t be the trader that let’s the losses add up while you take small little profits.

I published an article about using the daily time frame for trading. In that article, I used the 20 EMA and the ATR as part of the strategy. It takes into account closing price direction and the average range of price for stops and entries. Not a bad starting point for swing traders.

In the end, it is not the technical indicator that is going to give you success. It can help you frame the market and see things that you may not yet be able to read in price. Use it as an assist to learning how to read price action and patterns.

Further Reading

This may have burst a lot of bubbles that trading is as easy as finding the best indicator setting. If it were that simple, everyone would be trading and living a wealthy life in terms of finances.

You will find below some other tutorials that you may find useful on your road to profitable trading.