- September 4, 2015

- Posted by: CoachShane

- Categories: Swing Trading, Trading Article, trading videos

Trade entries are a much talked about trading topic and for good reason.

A trade entry close to a turning point gives a great risk to reward ratio while one that requires confirmation, can lessen the ratio and decrease your position sizing.

The problem is that often times it’s an area of interest you are looking at for your trade entry and not an exact market price.

It’s an area where you expect a change of state in the instrument and perhaps just getting the trade on is the right thing to do.

Trade Entry Confirmation Friend Or Foe

If we break a trade entry into two classifications we get:

- entry with confirmation

- entry when price is in the zone including a pattern zone

A trade entry with confirmation is simply having a signal once price hits your zone of interest that price/momentum is turning in your favor.

If price is in your zone, you simply enter the position, set your stop, and let the trade work itself out.

Is trade confirmation a good thing?

At the point of confirmation, all that is occurring is a sign that your trade direction is currently the favored direction. It certainly does not mean the trade will work out to target though as we have all seen price head in your direction and in the end, stop you out.

What confirmation for your trade entry can do is keep you out of emotional trading where your fear of missing out on a move has you buying/selling after a sustained run in price in either direction.

Let’s take a look at a simple and popular trade confirmation technique.

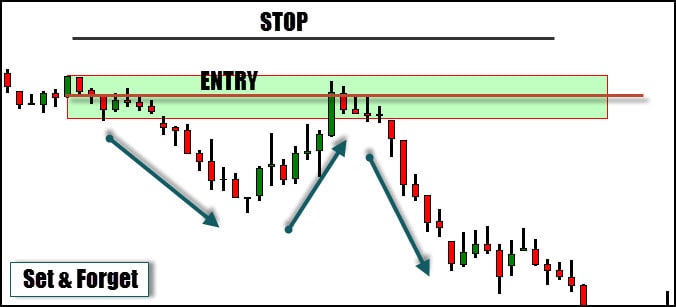

The left portion of the green box shows a consolidation pattern that supported price and eventually gave way to sellers. Price retraces back into the area and we expect sellers to once again return and drive price lower.

We knew where our stop would go long before price returned to the area. To avoid a failure test of the highs of the previous area, we keep our stop out of the line of fire. Too tight of a stop can have consequences as I laid out in the post Forex Swing Trade Error.

Our entry is simple: When price hits our zone we sell stop the first candle that puts in a lower low.

One important note is that I have never tested the validity of a simple break of the low or high of a candle in terms of increasing the odds of a trade. It may have an edge in the right context such as in the image displayed or from a lower time frame structure and that is something you’d want to test for yourself.

Set And Forget Trade Entry

Perhaps this appeals more to swing traders and that is where you have defined an area and simply place your buy or sell order to be executed when price enters your zone. It can be a risky play but again, context plays a role in virtually every aspect of trading.

I’ve taken quite a fair number of no confirmation trades over the years (also in the link above) and they can certainly allow a larger position size due to the smaller distance between your entry and stop.

This is the same chart however I’ve defined not only the range before the breakout, but a small pullback inside of the range to be used as the entry price for a set and forget style of trade entry.

Again, the stop is placed far enough away to allow for tests of the highs without stopping the trade out before it find its legs.

As with all trades, your money management will make or break your overall success so keep in mind your risk every single time you place a trade.

In-Depth Trade Entry Example

I will admit that trading without confirmation is not for everyone. Quite frankly, it does take a lot of variables in my favor to non-confirm a trade entry and opt for a trigger of some sort to get into the trade.

From my experience, most traders that I’ve spoken to will want to see some shift in the state of the market such as a structure break to get themselves into the trade.

This chart is a four hour chart giving an x-ray into a daily pullback in the context of an uptrend. Price has broken out of a resistance level and was in the middle of a retest. You are able to picture a two stage pullback from the daily chart but the four hour gives a better view.

- Red lines show the measured move from the first swing and then copied to the second swing (complex pullback)

- Dashed black line shows the termination of the measure move

- Blue lines are a trend channel

Remember, context matters

- Daily uptrend and pullback

- Complex correction

- Retest of previous resistance

- Defined trend channel

The yellow boxes highlight several areas where entries can be taken. The example is a recent move in the EURUSD and while hindsight, it is the only way to explain the concepts. That said, many of the posts of actual trading that I’ve made have shown these types of entries.

A. This range is the completion of the measured part of the pullback. While not a break out trader by nature, in these contexts these structure breaks make good entries when price breaks the high. It does not break in this instance and heads lower

NOTE: While the red candle rejection at the bottom trend line may look tempting, for myself this is not what I want to see in a failure test so while it works, it’s not an entry in my books

B. After the complex completion and a rejection at the demand line, price forms a range and once again, a break out of this structure is a good entry.

C. A price consolidation at the highs of a thrusting move are often a good entry area taking context into consideration

Once you recognize a trend continuation pattern is in play, look for structures inside the pullbacks to help get you into the move. I find complex pullbacks to be a safer bet because more often than not, if price continues past that second swing, the upside momentum does not look too favorable and it may be time to shift gears.

Which Trade Entry To Choose

All you can be given is examples but in the end all that matters is what you do. The more you need to see to get into a trade can often lead to a smaller position size as price pulls away from your potential stop area.

Structure breaks on lower time frames are often great doorways into a trade. The key is not to set your stop too close so the slight adverse movement of price does not stop you out.

Setting and forgetting in the right context can also be a good play depending on several factors such as trend, probability of flow at your zone, and how you can handle having an untended order in the market.

In the end though, having the mantra “setup + trigger = trade” may be the best for the vast majority of traders for most of their trades. There is something to be said to having a hands-on approach when risking money is the name of the game.