- November 25, 2021

- Posted by: CoachShane

- Category: Trading Article

The island reversal candlestick price pattern is a chart pattern that uses two gaps in the opposite direction with its formation.

The formation of the island reversal is best looked for during a a trending move in the instrument:

- You want the first gap to be in the direction of the main trend

- The second gap after the island is in the opposite direction of the main trend

- Traders may look for an increase in volume on both gaps

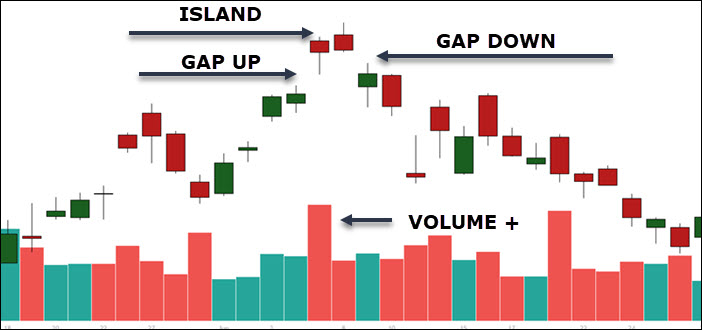

This is what an island top can look like – bearish pattern

Note that the second gap, the bearish gap, was not on unusual volume. Each trader will have to decide if volume is important to their strategy.

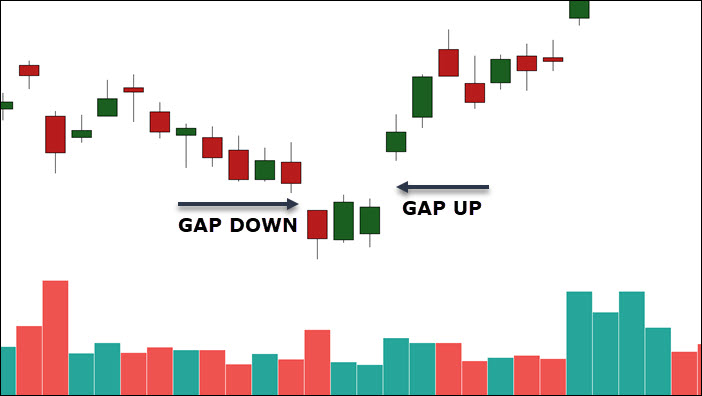

Island Bottom – Bullish pattern

The island bottom is a bullish reversal pattern and traders would be looking for long trades.

These patterns can be the first sign of a new trend. In effect, you are catching the the peak time to enter a new trend.

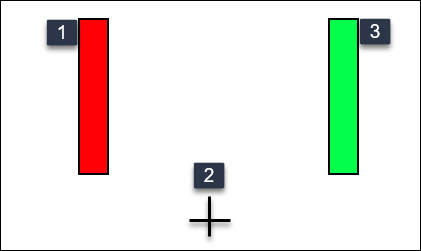

Abandoned Baby Pattern

The island reversal looks similar to the abandoned baby chart pattern.

The difference is the abandoned baby is not only a three candle pattern, the second candle is a doji.

There was a huge market for a long time where candlestick patterns were a big business.

- They were looked at as if they were infallible

- You need a perfect pattern to set up

In the end, look for the meaning of the pattern as the meaning is what matters, not the perfect formation.

Best Island Pattern Formation

You may not agree however for me, the island formation is best when:

- Price has been in an obvious trend

- First gap occurs and there is no overlap of the price points between the last candle in the trend and the gapped candle

- A series of candlesticks that make up the actual island

- The second gap up does not fill

What makes me believe that is the best?

Multiple candlesticks in the island it reminds me of a trading range.

A trading range is a market more or less in balance. The “bigger the brick, the bigger the break” theory comes to mind.

Inside the range, buyers and sellers are having a battle. The buyers are accumulating positions and if they win, the second gap happens in the opposite direction.

I don’t have the hard data, it is my theory. We could be looking at a lower probability of the second gap being filled due to the amount of time of the range consolidation.

How To Trade Island Reversal Candlestick Patterns

You may include other indicators such as RSI to measure oversold/overbought conditions. A moving average may help you determine the trend direction.

I won’t cover them here but you don’t have to trade this pattern in isolation.

How to enter the island reversal

Using a bullish reversal,

- Price is in an obvious downtrend

- Price gaps down with no overlap of price

- You see a multi-candlestick base form

- Price gaps up from the range

- Enter on the opening price of the candle OR using a lower time frame (5 minute chart) to find a pause in price

You can see the bullish island reversal pattern form with four days of consolidation.

Price gaps up out of the range and you can enter at the opening print of the day.

Is that the best way?

It depends on the trader.

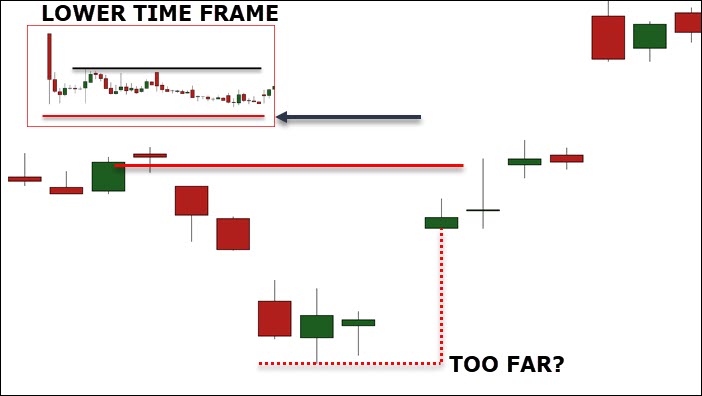

If you are a trader that can spend a few hours in the morning, you can watch a lower time frame chart. This is the one hour chart inset on the bigger daily chart.

Trader could also consider the opening range breakout strategy along with the island reversal pattern.

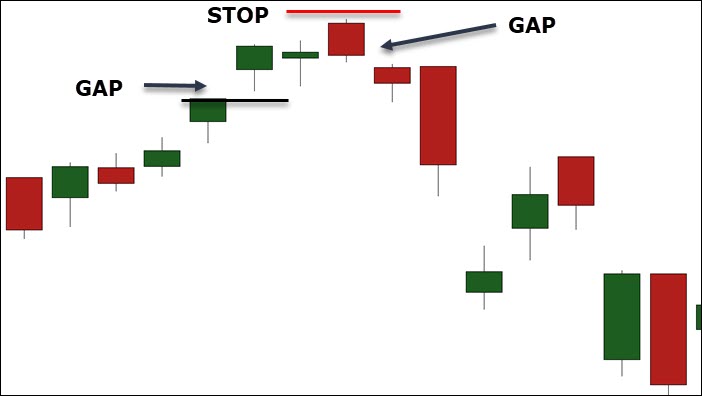

How to place your protective stop loss

The general approach is to place your protective stop loss at the extreme of the island reversal formation.

For a bearish island reversal, your stop can go above the high of the island.

There will be times when the second gap is wide and the price level for the stop is too rich for you.

In this case, you would want to consider using a lower time frame entry and stop loss placement.

If entering at the open, the only location you will have access to is the extreme of the pattern.

Entering on a lower time frames, you will find structure to tuck your stop behind.

How to find the minimum target for profits

We can always control, for the most part, where we will get out of a trade for a loss.

The profit target is something that is not definite. It is great to have a minimum goal but you must be open to trade management.

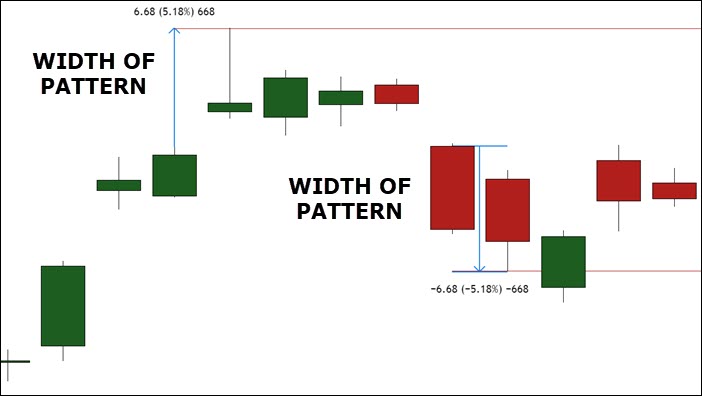

All you do is take the width of the first gap and project from the entry price.

This example has a $6.68 first gap size.

The profit target is the same amount from the end of the second gap.

Round Up

The Island reversal can take different forms but some keys are:

- The gaps up or down must not have an overlap with the island candles. There must be a pure gap with no gap fill

- You can trade one candle islands but my preference is a trading range as the island for reasons mentioned earlier

- Trade entry can be at the open or a lower time frame for a more precise entry

- Profit targets are the width from the first gap to the extreme of the island projected from your entry price

- Stops are from entry to extreme of pattern (or lower time frame structure)

One thing to take away from this is we are not trading the actual candlestick reversal pattern.

We are trading what the chart formation stands for. What does it mean? This is one reason I prefer an island of multiple candles as there is an accumulation (or distribution) taking place. When it breaks, it can be a new trend.