- August 15, 2024

- Posted by: Shane Daly

- Category: Trading Article

As you start your trading journey, you’ll quickly realize that market volatility is an unpredictable beast that can make or break your trading account. You might’ve already experienced the rush of a sudden price surge or the fear of a sudden downturn. To avoid getting caught off guard, you need to develop a solid understanding of volatility management.

Are you an options trader? Did you know 53% of options trades are now short term… or Zero-DTE options? If you want to profit from this hot new market, download your Free “Zero-DTE Options Trading Secrets” report NOW!

Understanding Market Volatility Basics

Market volatility is the degree of uncertainty or risk associated with the size of changes in a security’s value.

You’ll often hear volatility described as a measure of the market’s uncertainty or fear. When volatility is high, it means the market is experiencing large price swings, making it harder to predict what’ll happen next. You’ll want to gauge volatility to make well-informed trading choices.

To do this, you’ll use volatility indicators, which help you quantify and visualize market volatility. These indicators can be technical, such as the Average True Range (ATR) or Bollinger Bands, or they can be based on market sentiment, like the Volatility Index (VIX).

By analyzing these indicators, you’ll gain a better understanding of the market’s emotional state.

Market sentiment, a significant aspect of volatility, reflects the collective attitude of investors towards the market. When sentiment is overly bullish or bearish, it can lead to increased volatility.

You’ll need to take into account both volatility indicators and market sentiment to get a comprehensive view of the market’s volatility.

Setting Realistic Risk Expectations

As you evaluate the market volatility, it’s important to recognize that it’s not just about tracking indicators – it’s also about understanding what those indicators mean for your trading decisions. You need to set realistic risk expectations by acknowledging your risk tolerance.

This involves determining how much you’re willing to lose on a trade and understanding the potential consequences of a trade going sour.

You need to calibrate your risk tolerance with your emotional resilience. Can you stomach a string of losses, or will it shake your confidence in your trading and yourself? Be honest – it’s better to take small losses than to ride a losing trade.

Understanding support and resistance levels can help you make more educated decisions about potential market barriers and turning points, which is essential for managing risk effectively. While not a guarantee of a barrier, prices will often pause near these longer-term zones.

Your risk expectations should also be grounded in reality. Don’t expect to make 10% returns every month – it’s unsustainable. Be prepared for down months, and don’t get overly attached to your profits.

Position Sizing for Beginners

You’re likely to have heard the phrase “position sizing” thrown around in trading circles, but do you understand its significance in volatility management? As a beginner, understanding this concept is vital to handling market fluctuations effectively.

Fundamentally, position sizing refers to the process of determining the ideal amount of capital to allocate to a trade based on your risk tolerance and entry strategies. Vertical spreads can be an effective strategy for managing position size and balancing risk-reward ratios in options trading.

This approach allows traders to reduce costs while maintaining a defined risk profile.

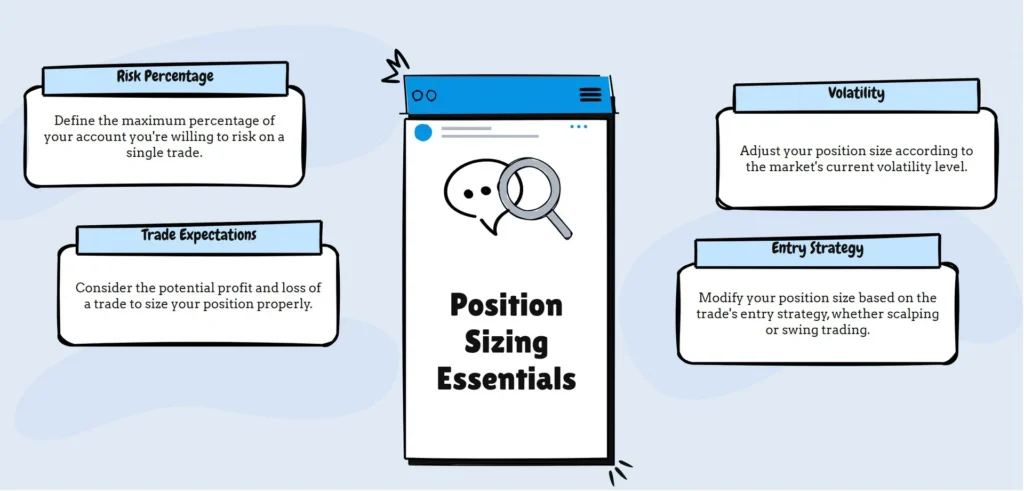

When it comes to position sizing, consider the following key factors:

- Risk percentage: Define the maximum percentage of your account you’re willing to risk on a single trade.

- Volatility: Take into account the market’s current volatility level to adjust your position size accordingly.

- Trade expectations: Consider the potential profit and loss of a trade and size your position accordingly.

- Entry strategy: Adjust your position size based on the trade’s entry strategy, such as a scalping or swing trading approach.

Managing Leverage Effectively

By the time you’ve understood position sizing, you’re likely to wonder how to improve your gains without overexposing your account to risk. This is where leverage comes in – a double-edged sword that can significantly increase your profits or wipe out your capital.

To manage leverage effectively, you need to understand your broker’s margin requirements and adjust your leverage strategies accordingly. Margin requirements vary among brokers and instruments, so it’s vital to know how much of your account balance is required to open and maintain a position.

Risk management techniques are fundamental for successful leverage management, with experts recommending personal risk limits of 1% to 5% per trade.

A general rule of thumb is to use a leverage ratio that allows you to withstand normal market fluctuations without exhausting your margin. As a beginner, it’s recommended to start with a conservative leverage ratio, such as 1:10 or 1:20, and adjust it as you gain more experience.

Example of Leverage

For instance, if you decide to use a 1:10 leverage ratio, this means that for every $1 of your capital, you can control $10 in the market. If you have $1,000 in your trading account, you could potentially trade up to $10,000 worth of assets. This allows you to amplify your potential returns, but it also increases your risk. If the market moves against you, your losses can also be magnified

Be aware that high leverage can result in significant losses if the market moves against you. Effective leverage management involves balancing risk and potential reward, and it’s important to develop a leverage strategy that aligns with your overall trading goals and risk tolerance.

Coping With Market Shocks

Several market shocks can catch traders off guard, leaving them vulnerable to significant losses. When unexpected events occur, you’ll likely experience strong emotions, such as fear, anxiety, or panic. These emotions can lead to impulsive decisions, causing you to deviate from your trading strategy.

To cope with market shocks, you must develop emotional resilience, which enables you to manage your emotions and react calmly to adverse market conditions. Emotional detachment techniques can help traders maintain objectivity and make rational decisions during turbulent market conditions.

Here are some strategies to help you cope with market shocks:

- Stay informed, but avoid emotional news: Stay up-to-date with market news, but avoid sensationalized or emotional reporting that can trigger impulsive decisions.

- Maintain a trading plan: A well-thought-out trading plan helps you stay focused on your strategy, reducing the likelihood of impulsive decisions.

- Diversify your portfolio: Spread your risk across multiple assets to minimize the impact of market shocks on your overall portfolio.

- Practice emotional self-awareness: Recognize and acknowledge your emotions, taking a step back to assess the situation before making any decisions.

Identifying High-Risk Trading Scenarios

As market shocks can significantly impact your trading performance, it’s just as vital to identify high-risk trading scenarios that can exacerbate these shocks. You must develop a keen sense of risk assessment to navigate these situations effectively.

Start by analyzing market indicators, such as volatility patterns and news impact, to gauge market sentiment. This will help you identify potential flashpoints that can trigger sudden price movements.

Next, examine your trading psychology and emotional discipline. Are you prone to impulsive decisions or emotional reactions to market fluctuations?

If so, develop strategies to improve your emotional discipline, such as setting clear goals and risk tolerance levels. Be honest with yourself about your risk tolerance and adjust your trading strategy accordingly.

Adapting to Changing Conditions

Your ability to adapt to changing market conditions is essential in volatility management. As a trader, you’ll face numerous scenarios where market conditions shift suddenly, and your ability to adjust will determine your success.

Developing market adaptability strategies is vital to surviving in volatile markets. Utilizing market internal tools can provide deeper insights into market strengths and weaknesses, helping you make more educated decisions (and potentially profitable ones) during volatile periods.

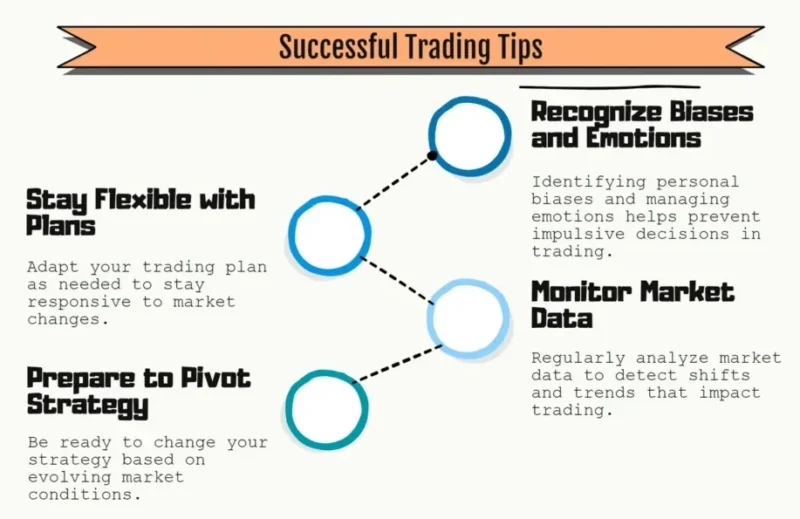

To adapt, you’ll need to make trading psychology adjustments. This includes:

- Recognizing your biases and emotions to avoid impulsive decisions

- Staying flexible with your trading plan and adjusting it as needed

- Continuously monitoring and analyzing market data to identify changes

- Being prepared to pivot your strategy when market conditions dictate a change

Common Volatility Mistakes

When dealing with volatile markets, it’s vital to recognize that even the most experienced traders can fall victim to common mistakes that can severely impact their performance. You’re not immune to these pitfalls, but being aware of them can help you avoid them.

One common mistake is relying too heavily on volatility indicators. While they can provide valuable insights, they’re not foolproof. Overreliance on these indicators can lead to complacency, causing you to overlook other important market signals. It’s important to diversify your analytical tools and stay up to date on any market changes.

Another mistake is letting emotions cloud your judgment. When markets become volatile, it’s natural to feel anxious or fearful. However, it’s critical to maintain emotional resilience. You must develop a trading plan that accounts for your emotional responses and stick to it. This will help you avoid impulsive decisions that can result in significant losses.

Additionally, you may fall into the trap of over-trading or revenge-trading. This can lead to a cycle of losses and further exacerbate your emotional state.

Frequently Asked Questions

How Do I Know if a Stock Is Volatile or Not?

You determine a stock’s volatility by analyzing its historical trends, such as price swings and trading ranges, and utilizing volatility indicators like Bollinger Bands or Average True Range to gauge its price fluctuations over time.

Can I Use Volatility to Predict Market Direction?

When analyzing volatility indicators, you’ll find they’re a rear-view mirror, not a crystal ball; they reflect past market sentiment, but don’t necessarily predict future direction; instead, they help you gauge risk, allowing you to adjust your strategy accordingly.

Is Options Trading the Same as Volatility Trading?

Not exactly, as options trading involves buying and selling options contracts using various strategies, while volatility trading focuses on profiting from volatility measurement and predictions.

How Does News Impact Volatility in the Markets?

You analyze news catalysts, observe how market reactions shift based on economic indicators, and conduct sentiment analysis to gauge market emotions, as news can trigger sudden volatility spikes or subtle shifts in market sentiment, impacting your trading decisions.

Can I Hedge Against Volatility Using Multiple Accounts?

You’re wondering if you can hedge against volatility by using multiple accounts and leveraging account diversification to minimize risk. Through careful risk assessment, you can spread your capital across accounts, mitigating potential losses and optimizing returns.

Estimated reading time: 10 minutes

Conclusion

By now, you should understand the basics of volatility management. You’ve set realistic risk expectations, learned position sizing, and understand how to cope with market shocks. Remember to identify high-risk scenarios, adapt to changing conditions, and avoid the common mistakes most traders make. As a newbie trader, it’s essential to stick to your plan, diversify your portfolio, and continuously monitor your risk exposure. Effective volatility management will be your guard against impulsive decisions and market uncertainty, ultimately leading to more educated and profitable trades.