- September 7, 2024

- Posted by: CoachShane

- Categories: Trading Article, Trading Tutorials

Balancing risk and reward in trading is needed for long-term success and financial stability. By implementing a well-defined risk-reward ratio, such as 1:3, you’ll optimize your potential profits while limiting losses. This approach enhances your emotional resilience, promoting disciplined decision-making and mitigating impulsive reactions.

Diversification and strategic risk management techniques, like stop-loss orders, further protect your portfolio. Understanding market volatility and risk tolerance is part of every effective trading strategy.

Defining Risk-Reward Balance

Every successful trader understands the needed role of balancing risk and reward. This balance is quantified through risk-reward ratios, which compare potential losses to potential gains.

Day trading strategies require an understanding of market conditions and trader psychology, which are needed for managing risk effectively.

Risk-reward ratios, such as 1:3, illustrate that for every dollar risked, you could potentially gain three. This balance is needed for managing your capital and achieving your financial objectives. By maintaining favorable ratios, you increase your chances of overall profitability, even when some trades result in losses.

To define your ideal risk-reward balance, consider your individual risk tolerance and trading goals. These factors should guide your decision-making process and help you tailor your trading strategies.

Implementing tools like stop-loss orders can assist in managing potential losses while diversifying your portfolio can help spread risk.

Benefits of Balanced Trading

While many traders focus only on profits, adopting a balanced approach to trading offers many advantages. By considering both risk and reward, you’ll optimize your risk/reward ratios, ensuring potential profits outweigh potential losses. This strategy is needed for achieving sustainable profitability and meeting your long-term financial goals.

Consider the following benefits of balanced trading:

| Benefit | Impact | Long-term Effect |

|---|---|---|

| Optimized risk/reward | Higher potential profit | Sustainable profitability |

| Diversification | Reduced portfolio risk | Improved financial stability |

| Emotional resilience | Consistent decision-making | Enhanced trading performance |

A well-balanced trading approach allows you to manage your exposure to market volatility effectively.

By diversifying your investment portfolio across various asset classes and sectors, you’ll mitigate risks associated with individual assets while still pursuing attractive returns. This balanced strategy can significantly improve your emotional resilience, encouraging disciplined decision-making rather than impulsive reactions to market fluctuations.

Strategies for Risk Management

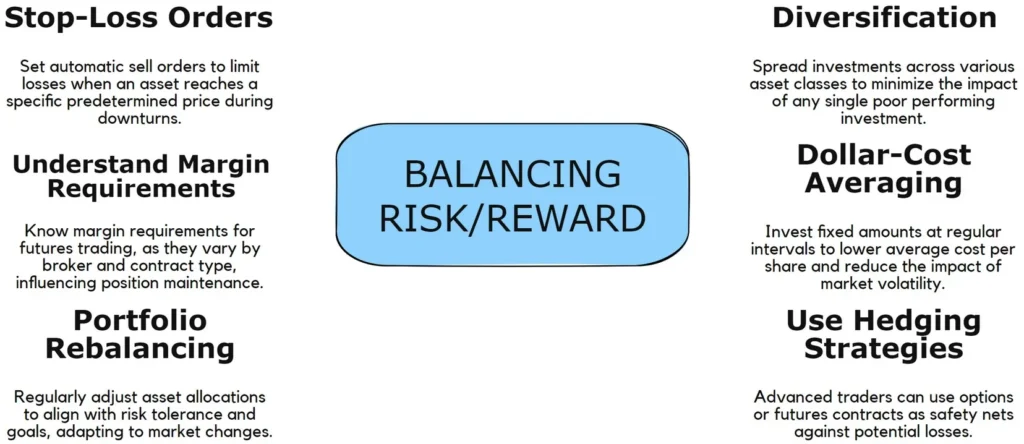

We’ve looked at the benefits of balanced trading, let’s focus on specific strategies for managing risk effectively. To balance risk and reward in your strategy, you’ll need to use a variety of techniques that protect your capital while still allowing for growth.

One needed method is implementing stop-loss orders, which automatically sell an asset when it reaches a predetermined price, limiting potential losses during market downturns.

Diversification across various asset classes is another key strategy, spreading your exposure and minimizing the impact of any single investment’s poor performance.

When trading futures, understanding margin requirements is needed, as they vary by broker and contract type, affecting your ability to maintain positions.

Consider utilizing dollar-cost averaging, and investing fixed amounts at regular intervals to mitigate the effects of market volatility and lower your average cost per share over time.

Regular portfolio rebalancing is essential to ensure your asset allocations remain aligned with your risk tolerance and goals, adapting to changes in market conditions.

For more advanced traders, using hedging strategies such as options or futures contracts can provide a safety net against potential losses.

These techniques allow you to protect your investments while still looking for growth opportunities, effectively managing the risk of an investment in volatile markets.

Psychological Aspects of Balance

Trading isn’t just about numbers and charts; it’s equally about managing your emotions and mindset. As an investor, you must understand the psychological aspects of balancing risk and reward to achieve your financial goals.

Behavioral finance studies have shown that many investors exhibit loss aversion, often preferring to avoid losses rather than acquire equivalent gains. This psychological bias can skew your risk assessment and lead to poor decision-making in the market.

Emotional turmoil can cloud judgment and market perception, potentially disrupting control and discipline in your trading activities.

To counteract these tendencies, consider the following:

- Develop a well-defined risk-reward ratio

- Maintain awareness of personal risk tolerance

- Recognize and mitigate psychological biases

By implementing these strategies, you’ll experience lower levels of stress and anxiety, promoting more disciplined trading behavior.

A balanced approach helps mitigate the “gambler’s fallacy,” preventing reckless risk-taking based on misguided beliefs about future gains and compensating for past losses.

In the long term, successful traders understand the importance of maintaining emotional equilibrium. By acknowledging the potential impact of psychological biases on your decision-making process, you’ll be better equipped to navigate the complex world of financial markets and achieve your investment objectives.

Long-Term Sustainability in Trading

For long-term sustainability in trading, balancing risk and reward is needed. Your ability to maintain a healthy balance between risk and potential reward will significantly impact your investment portfolio’s longevity.

By implementing a well-calibrated risk-reward ratio, ideally around 1:2 or 1:3, you’ll position yourself to achieve profitability over time, even if you encounter a higher number of losing trades. Using technical indicators like MACD and RSI can help you identify potential trend reversals and market sentiment shifts, improving your ability to make better decisions and maintain a balanced approach to risk and reward.

To deal with potential losses and recover from market fluctuations, consistently apply risk management techniques such as stop-loss orders and position sizing. These strategies will help you maintain a sustainable level of risk while maximizing your potential for long-term gains.

Remember, research indicates that traders who adhere to a disciplined approach in balancing risk and reward are more likely to achieve consistent returns.

Avoid emotional decision-making, which can lead to a 30% decrease in profitability. Instead, focus on maintaining a rational, data-driven approach to your trading decisions.

Summary

By implementing sound risk management strategies, you’re better equipped to navigate market volatility and protect your capital. Remember, successful trading isn’t just about maximizing profits; it’s about preserving your ability to trade another day. As you refine your approach, continue to reassess your risk tolerance, adjust your strategies, and maintain emotional equilibrium. With discipline and a balanced perspective, you’ll be well-positioned for long-term trading success.