- April 6, 2018

- Posted by: CoachMike

- Categories: Options Trading, Stock Trading, Trade Of The Week, Trading Article

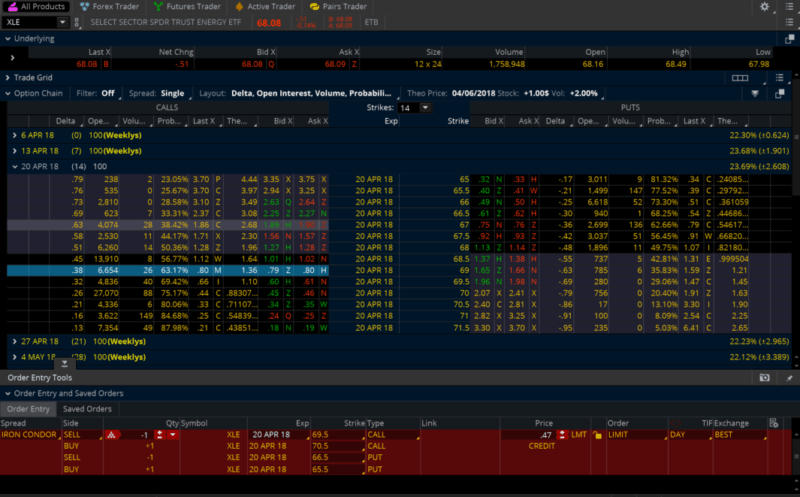

In this week’s NetPicks Options Trade Of The Week, we will take a look at an Iron Condor on XLE which is the energy ETF that we trade.

Looking at the chart below, we can see that XLE has been stuck in a sideways range for the last number of weeks. This is coming off a few months back in late 2017 and early 2018 where we had big moves in both directions.

It is normal for a stock to consolidate after big gains like this and because of that, we are looking to take a trade that will benefit from sideways move.

That is why Options trading is an important part of the trading business of many traders.

The flexibility that Options trading has especially when we are faced with sideways price movement in any instrument where we can trade the Option contract instead of the underlying asset.

What is An Iron Condor Options Trade?

The Iron Condor is where traders sell an out of the money call spread and an out of the money put spread at the same time. While many traders get intimidated by selling options, this is actually a very safe trade.

By selling spreads, we are able to be in a risk defined trade. We know what our maximum loss would be if we are dead wrong on market direction. This helps me sleep better at night, especially in a volatile environment like we are seeing right now in equities.

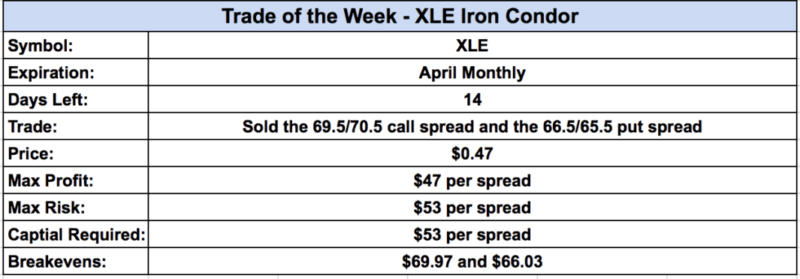

Iron Condor Trade Details

- We are selling the April 69.5/70.5 call spread and the 66.5/65.5 put spread at the same time.

- We are collecting $.47 per spread which gives us a maximum profit potential of $47 per spread.

- We are risking $53 per spread to put the trade on.

Break Even Points + 5 Ways To Make Money

We have 2 break-even points on this trade at $69.97 and $66.03.

These break evens define our profit window that we need XLE to stay inside of. As long as price stays inside of our profit window we get to make money.

We don’t care if price:

- Moves higher

- Moves lower

- Moves sideways

We also make money from time decay adding up and volatility decreasing. This means we have 5 different ways of making money on the trade.

The Iron Condor won’t leave us with a home run profit potential but it is a great way to generate some income in a choppy market environment. We will track this trade over the next few weeks to see if we can book a profit on XLE.